[ad_1]

When you go away your contact heart uncovered to poor governance, lax processes, or inadequate know-how, count on fines, reputational harm, and even regulatory motion requiring you to cease working (in excessive circumstances).

Contact heart compliance isn’t any gentle matter. Fortunately, there are a number of contact heart options designed to mitigate these dangers and show you how to keep present with the dangers related to working in several industries.

On this information, we introduce the dangers and clarify how your brokers can preserve your contact heart safe and cling to compliance tips.

Let’s begin by attending to know the various kinds of contact heart compliance.

What Are the Completely different Forms of Compliance in Contact Facilities?

From HIPAA to PCI DSS to FINRA to non-discrimination compliance, let’s check out the totally different sorts of compliance when it come to contact facilities.

HIPAA: Well being Insurance coverage Portability and Accountability Act

HIPAA isn’t only a greatest observe for healthcare name facilities however a set of governing tips that each healthcare enterprise should adhere to.

Subsequently, HIPAA applies to contact heart operations within the healthcare {industry}, together with all well being info suppliers, clearinghouses, and any area of interest companies that conduct sure healthcare transactions electronically.

HIPAA doesn’t apply to:

- Life insurers

- Employees’ compensation carriers

- Most faculties and college districts

- State businesses like baby protecting service businesses

To stick to HIPAA compliance, brokers should:

- Confirm affected person identities earlier than accessing medical info

- Securely transmit and retailer well being information

- Receive affected person consent for sharing info

PCI DSS: Fee Card Trade Knowledge Safety Commonplace

The PCI DSS is a kind of compliance tips that applies not solely to all contact facilities but additionally to any enterprise that handles bank card funds.

The PCI DSS dictates that contact heart brokers should:

- By no means retailer full bank card information

- Use safe fee processing programs

- Be skilled in figuring out and stopping bank card fraud

There are 4 ranges of PCI DSS your contact heart could also be topic to that relate to the variety of card transactions you course of annually:

- PCI Stage 1: six million transactions or extra

- PCI Stage 2: a million to 6 million transactions

- PCI Stage 3: 20,000 to at least one million transactions

- PCI Stage 4: underneath 20,000 transactions

👀 Additional Studying: Gathering Credit score Card Funds Securely with Nextiva’s Superior IVR

FINRA: Monetary Trade Regulatory Authority

When you’re a contact heart within the monetary companies {industry}, you’ll be topic to FINRA compliance. FINRA states that laws are “devoted to defending traders and safeguarding market integrity in a way that facilitates vibrant capital markets.”

Corporations regulated by FINRA embody:

- Dealer–supplier corporations

- Capital acquisition brokers

- Funding portals

FINRA states that your brokers should:

- Keep correct buyer data

- Keep away from making deceptive or unauthorized funding suggestions

- Adjust to record-keeping compliance laws for monetary transactions

Non-discrimination compliance

Each contact heart should adhere to non-discrimination compliance. This ensures that every one brokers, employers, and companies don’t forged bias, favor, or judgment primarily based on any of the next elements:

- Race

- Coloration

- Faith

- Intercourse

- Nationwide origin

- Age

- Incapacity

- Genetic info

Non-discrimination compliance requires brokers to:

- Present equal service to all clients no matter potential discriminatory elements

- Keep away from making discriminatory statements or assumptions

- Uphold firm insurance policies on variety and inclusion

How Contact Heart Brokers Can Keep Compliance

On the floor, it looks like sustaining contact heart compliance needs to be straightforward. However a busy atmosphere or brokers who work unmonitored in varied places may expose your small business to non-compliance.

Use these 4 strategies to bulletproof your contact heart from formal complaints and devastating information breaches.

1. In-depth coaching periods

The extra , the extra you understand you don’t know. This isn’t only a intelligent assertion from the Greek thinker Aristotle however a relatable state of affairs involved facilities.

Offering common coaching to brokers and supervisors gained’t simply ensure that they’re at all times updated on related laws. It’ll additionally uncover areas of weak point and uncertainty. For instance, if you happen to exceed your transaction restrict and at the moment are topic to a brand new PCI degree, a supervisor could flag this and talk it to the group.

Banks like JPMorgan Chase, Wells Fargo, and Goldman Sachs spend money on compliance coaching to make sure that staff perceive monetary laws, relevant legal guidelines, and different industry-specific compliance necessities. These all assist them adhere to a wide range of contact heart compliance tips and keep away from large penalties.

Likewise, new brokers could also be not sure about sure phrases which can be/aren’t allowed when addressing totally different clients. At all times gather suggestions following your coaching periods to remain on the ball.

Google states that it provides rigorous compliance coaching to its staff. These cowl areas like:

- Moral conduct

- Authorized necessities

- Firm insurance policies

One other space of focus is information safety coaching, which we’ll cowl within the subsequent part.

2. Knowledge safety

Brokers have to be aware of firm information safety protocols and observe procedures for dealing with delicate buyer info. These could apply to US legal guidelines just like the California Client Privateness Act or European legal guidelines just like the Common Knowledge Safety Regulation.

Agent protocols and procedures contain confirming caller’s identities and multi-factor authentication for inner instruments.

However some facets aren’t the duty of brokers. Contact heart administration and IT are answerable for:

- Knowledge masking (e.g., hiding bank card particulars when clients enter them)

- Encrypted telephone calls (the place related)

- Common compliance audits

- Formal incident response plans

- Contact heart software program updates

Non-compliance with these guidelines or perhaps a small blip in process can result in vital penalties. Non-adherence to any contact heart compliance can carry fines or suspension, even when it solely occurred as soon as.

3. Buyer interactions

When coping with clients, brokers should know what private information they’ll and may’t gather or ask for. Asking for telephone numbers, financial institution particulars, and different personally identifiable info should solely occur after you’ve gained express consent.

Word: You want this to stick to the Phone Client Safety Act.

Even when callers provide these particulars themselves, your small business is accountable for making certain buyer information is retained (with permission) or deleted, as acceptable. You need to additionally pay particular consideration to do-not-call lists to keep away from impacting buyer loyalty when folks have opted out, which can embody guide entries into CRMs or automated seize when recording calls.

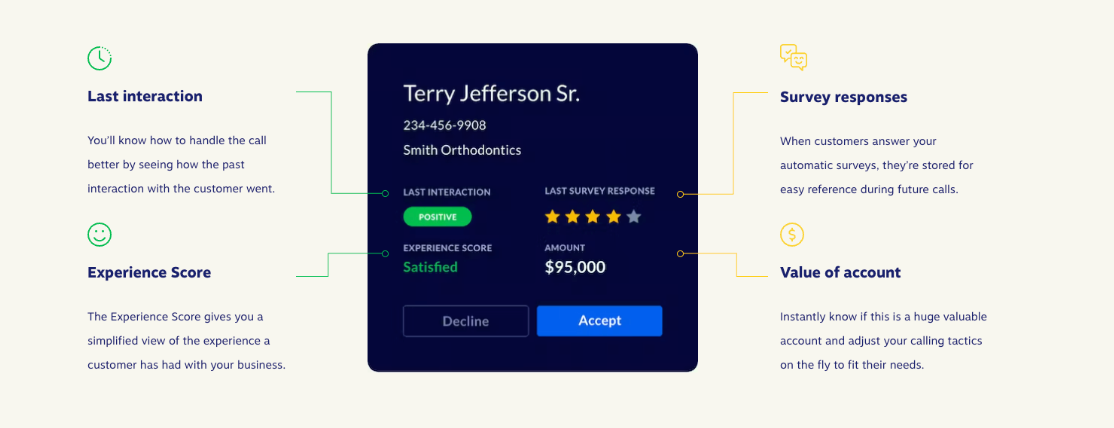

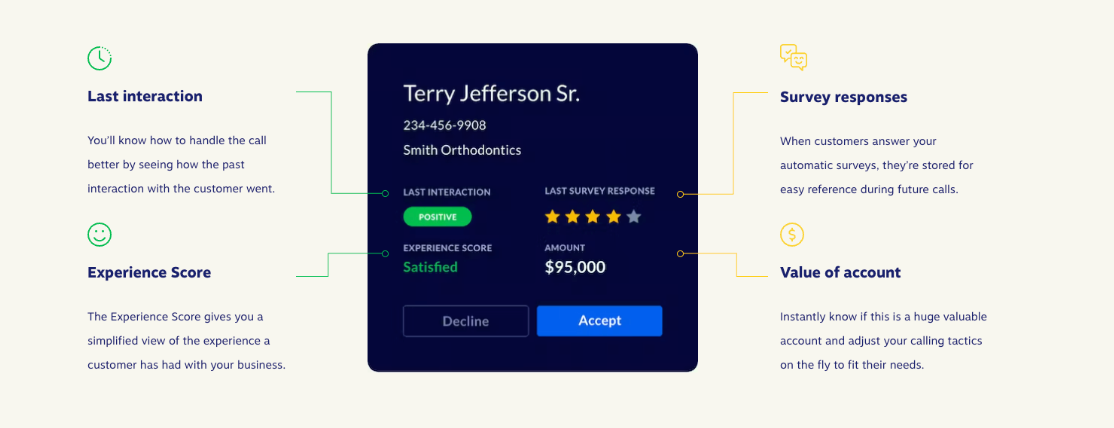

In the beginning of any name or omnichannel interplay (internet chat, e-mail, SMS, and so on.), brokers should confirm the client’s id earlier than accessing delicate info. Failure to take action could permit unauthorized events to entry buyer accounts and knowledge.

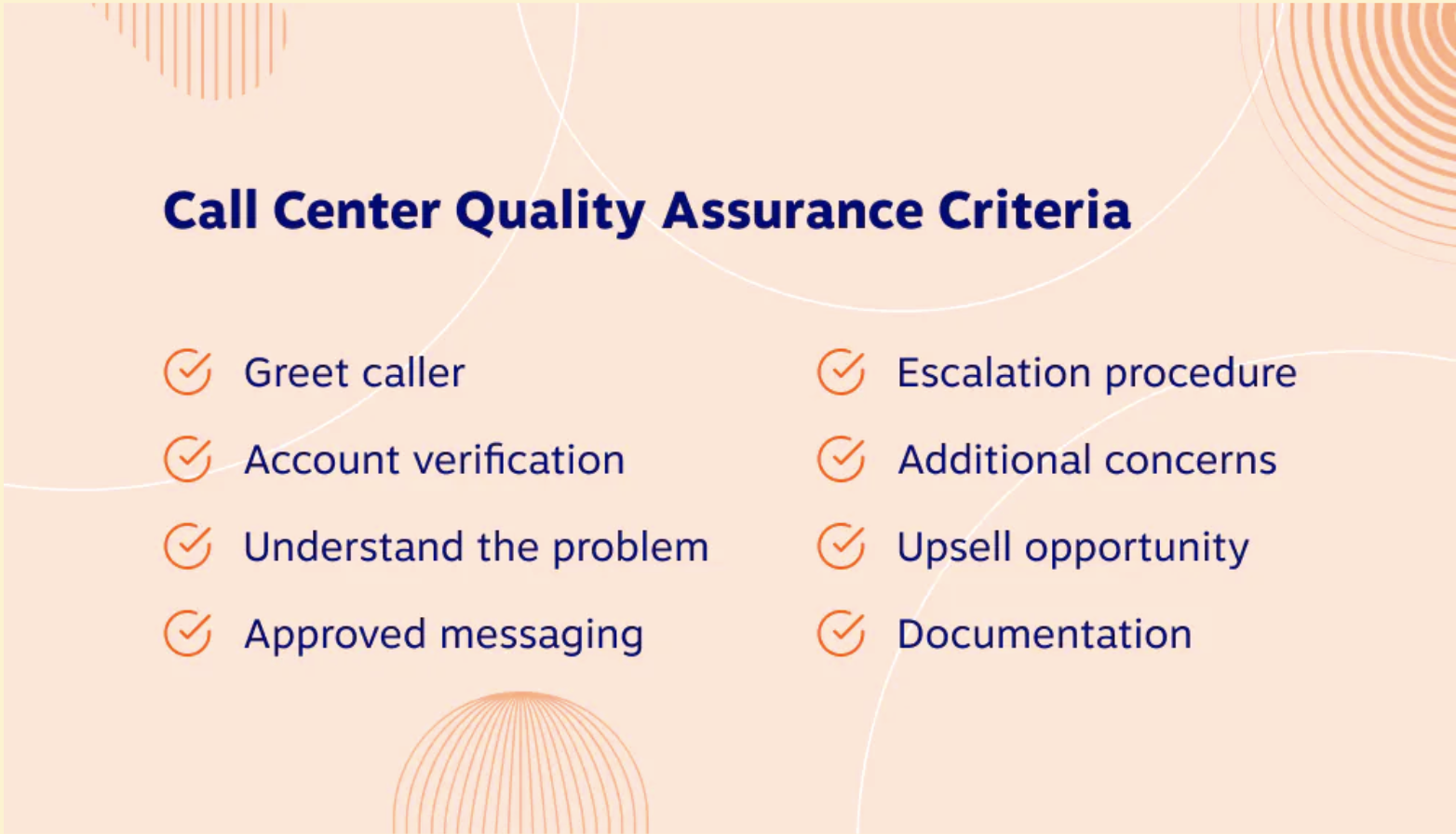

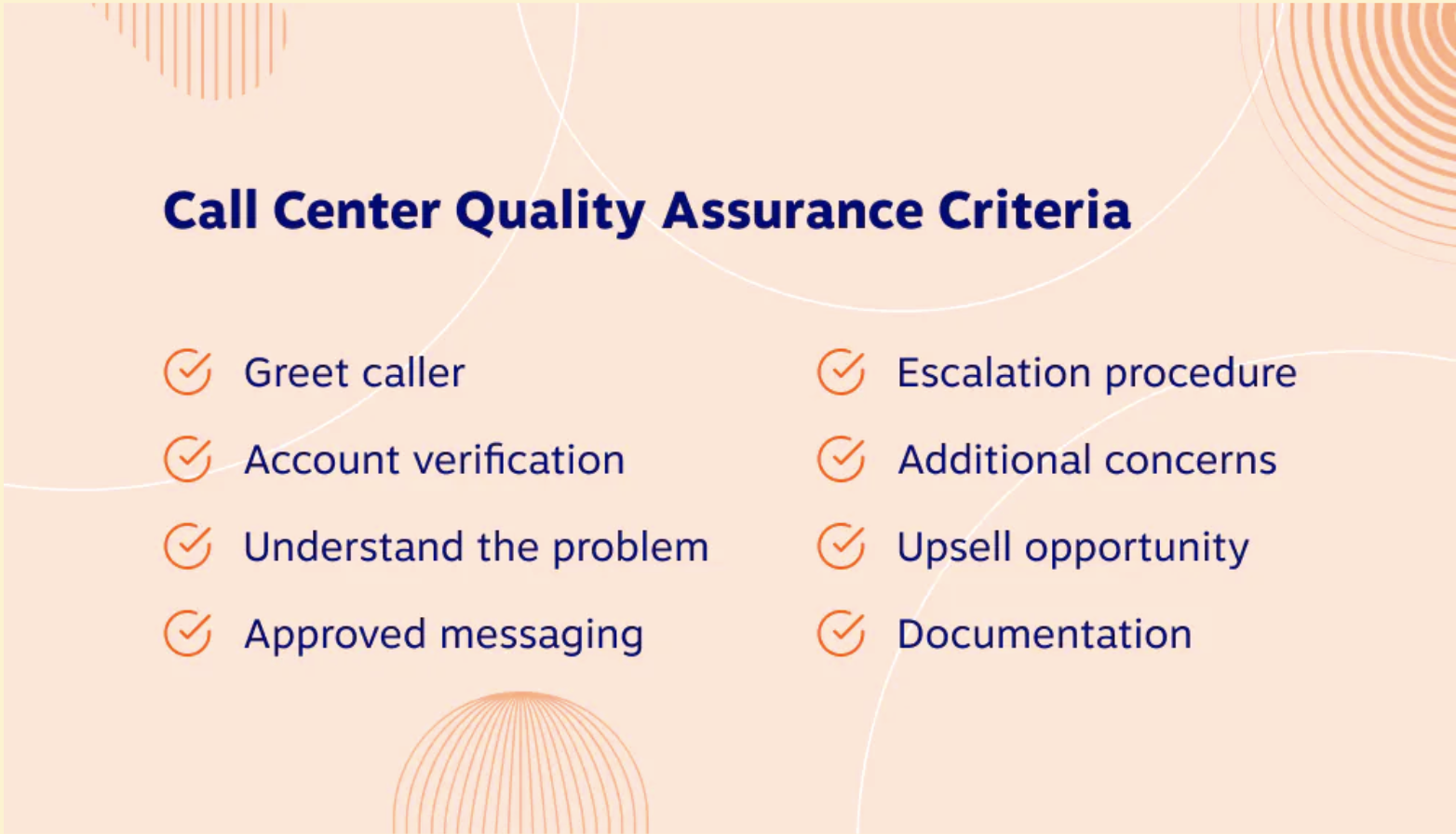

Guarantee all name heart brokers adhere to verification and identification procedures by following a strict high quality assurance course of.

Throughout calls, guarantee brokers keep away from making discriminatory remarks or providing biased recommendation. Avoiding these feedback ought to tie into your common coaching plans and training initiatives.

It additionally pays to maintain an inventory of widespread phrases which can be required so as to keep contact heart compliance.

Listed below are a number of examples to contemplate:

- “All our calls are recorded for coaching and monitoring. Is that okay with you?”

- “Do you agree with us preserving your info on document?”

- “Is it okay if we use that e-mail handle/telephone quantity for advertising functions?”

- “Would you wish to choose in to obtain additional updates?”

- “Do we’ve permission to make use of that contact quantity for billing?”

4. File preserving

By precisely or mechanically documenting buyer interactions in response to firm tips, you stand the perfect likelihood of getting high-quality information and knowledge. Counting on guide information enter or brokers updating data hours after a name leaves you open to error and misinformation.

When updating current data, ensure that solely licensed personnel could make adjustments to name recordings, transcripts, notes, and different very important info.

You probably have particular laws for information retention, be sure to observe these directions to the smallest element. If brokers, supervisors, or admins are unaware of even the tiniest bit of knowledge that applies to sure transactions, incorrectly altering a document may have main repercussions.

How Contact Heart Applied sciences Strengthen Compliance

Nearly each contact heart should abide by some tips or governing physique. That’s why we see loads of options that show you how to keep compliant.

Name recording

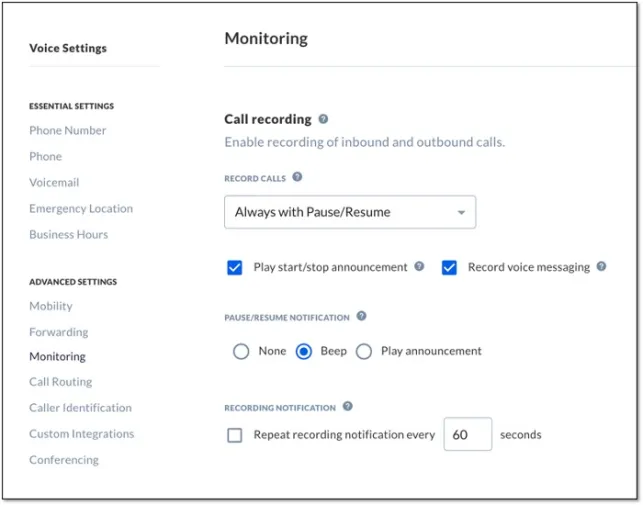

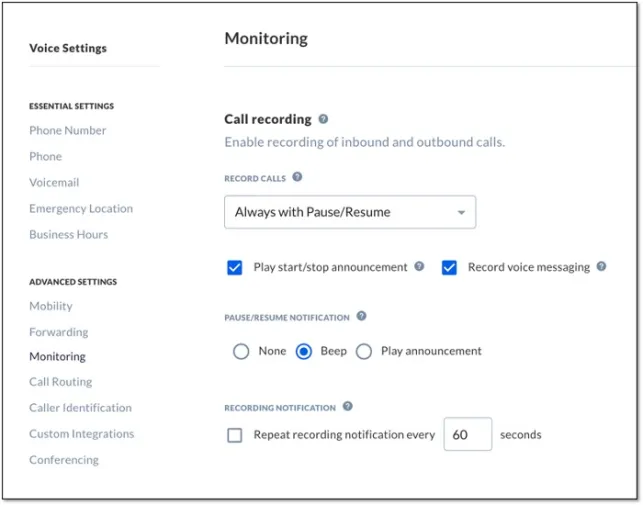

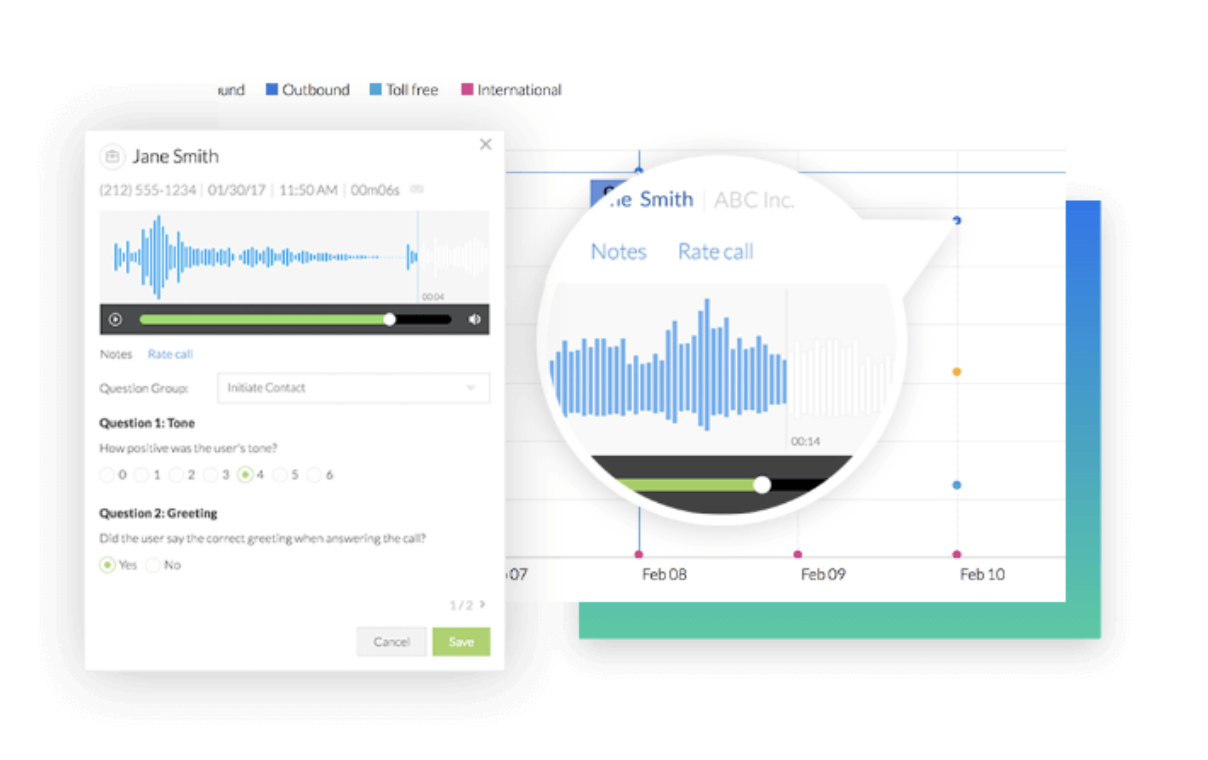

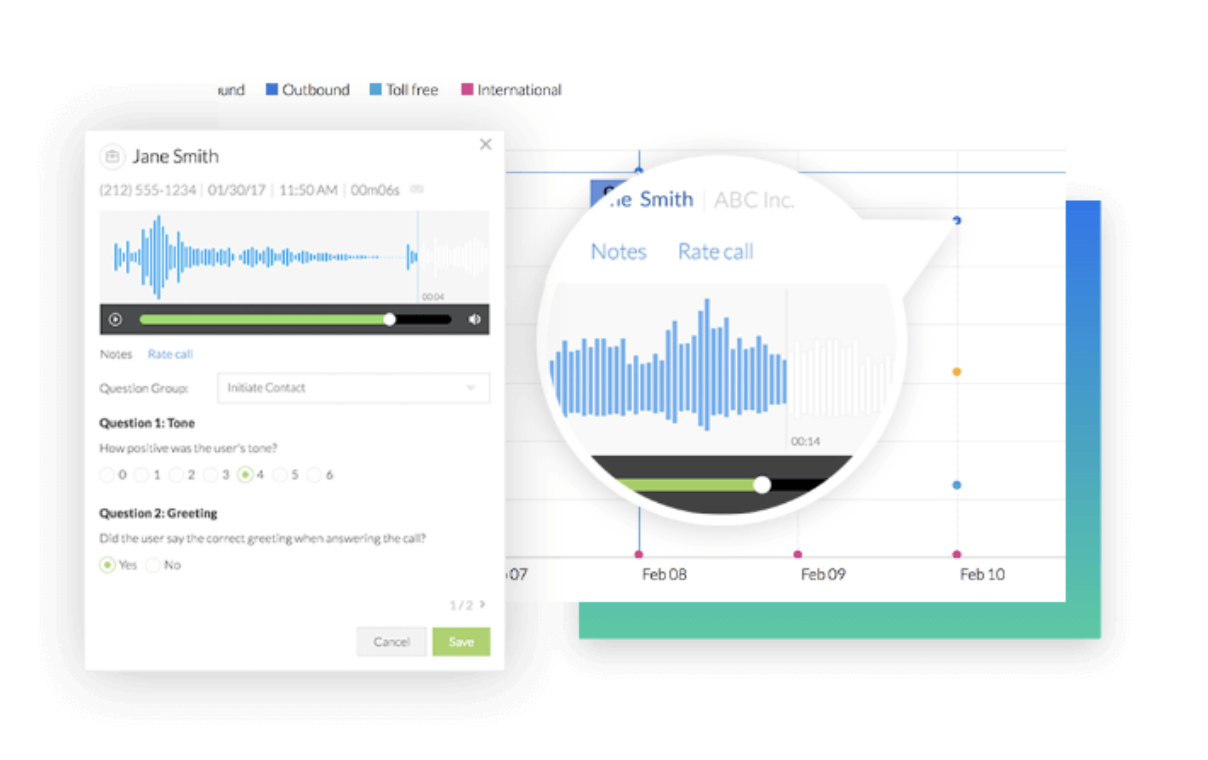

Name recording offers a document of interactions for evaluation, making certain brokers adopted correct procedures and adhered to laws.

You may make evaluating random or focused calls a part of your high quality administration process to ensure brokers are utilizing the suitable scripts, asking clients to move id and verification, and pausing recordings when capturing bank card particulars.

Within the screenshot beneath, see how Nextiva provides a Pause/Resume operate to maintain you PCI compliant when dealing with funds.

It’s also possible to use name recording for compliance audits and investigations. If there may be an incident and also you want bodily proof that you simply adhered to contact heart compliance, your name recordings are there to maintain you secure.

Disposition monitoring

When your brokers use disposition codes to flag the kind of name, this enforces constant categorization of calls primarily based on the character of every buyer interplay. Not solely is this useful for realizing why clients are calling you, nevertheless it additionally helps establish areas the place compliance could be in danger.

For instance, a excessive variety of deserted calls in a telemarketing calls setting may elevate pressure-selling considerations. When this will get flagged on a disposition report, you may examine potential points and get forward of compliance considerations.

Agent workflows

Sticking to contact heart compliance is straightforward if brokers have a step-by-step course of for advanced procedures.

Id and verification procedures firstly of a name may observe a three-step compliance guidelines:

- Ask for the caller’s identify and account quantity

- Confirm the account with a passphrase, handle info or telephone quantity

- Verify a novel transaction on their account for further safety

These ways are commonplace when clients overlook their on-line banking password. For instance, to confirm {that a} caller is who they are saying they’re, they need to affirm the date and quantity of one in all their final transactions.

Even a course of so simple as this reduces the chance of lacking essential compliance steps throughout calls and ensures consistency in dealing with delicate info.

With new and even seasoned brokers, it’s not unusual to see sticky notes, posters, or wall playing cards with continuously used processes in an workplace.

Think about using automated quantity identification (ANI) to hurry up id verification.

AI-powered teaching and reminders

Within the period of contact heart AI and automation, there are some easy agent assists you may introduce. An AI assistant will help coach brokers by way of delicate information dealing with situations and flag reminders after they’re going off script.

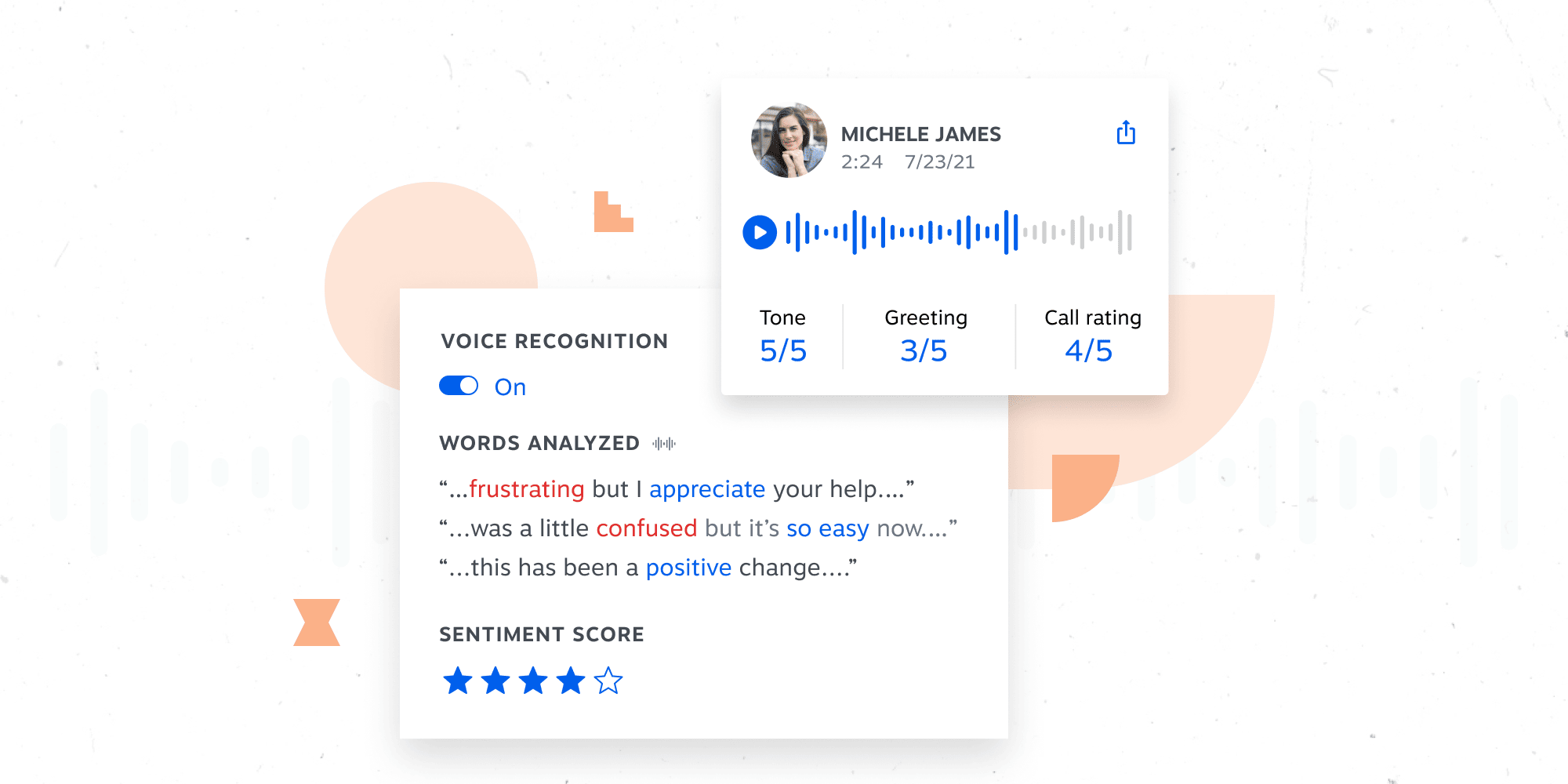

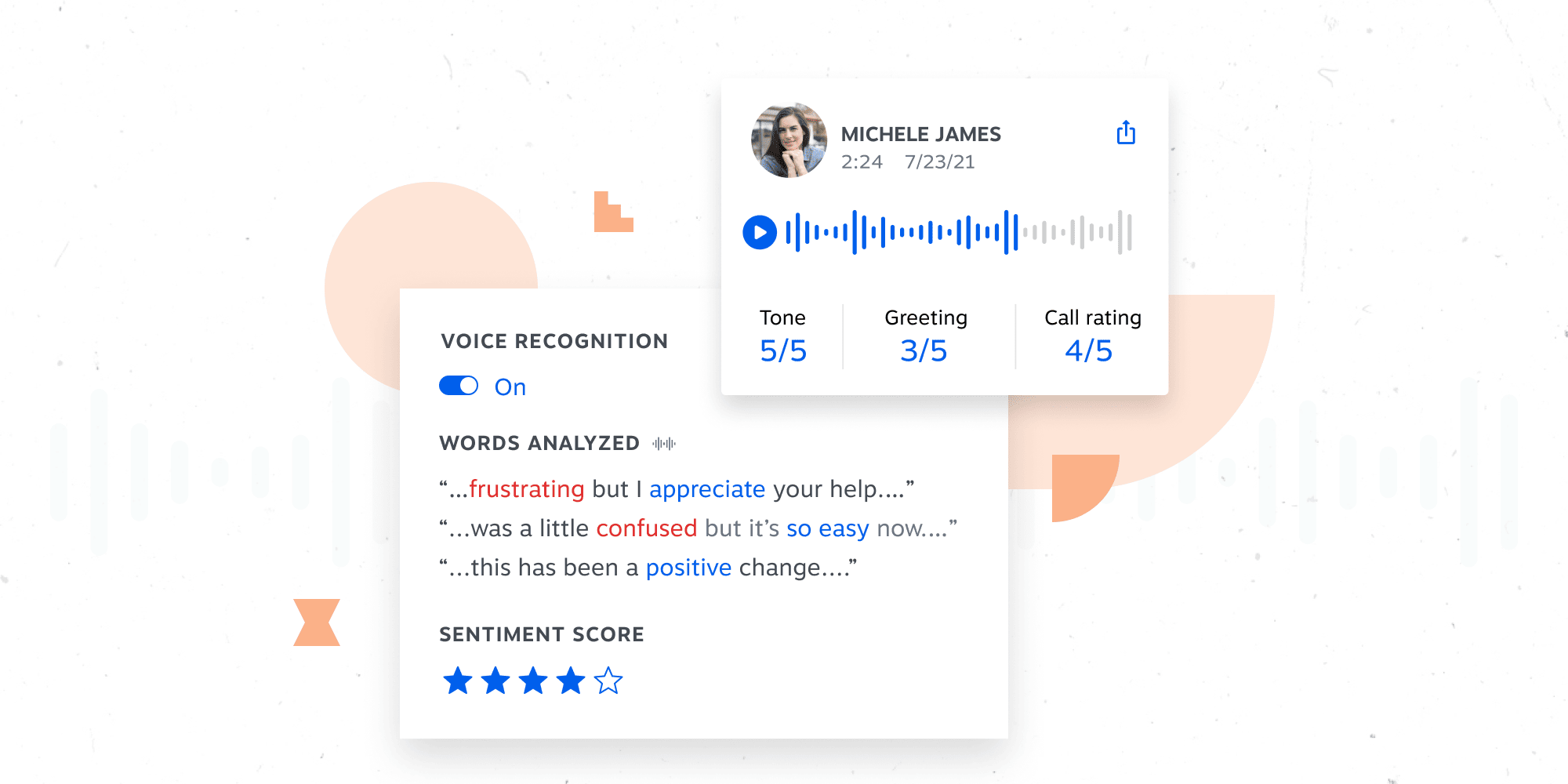

AI analyzes name recordings in actual time to establish potential compliance points like utilizing discriminatory language or failing to say required disclosures. When this occurs, brokers get an on-screen notification, and AI can inform supervisors to allow them to take over the decision.

After the occasion, these calls are flagged for evaluation. You need to use good and unhealthy calls to coach new brokers by eradicating principle and introducing real-world situations.

AI-assisted name auditing and recording

AI also can assist by scanning name recordings for key phrases or phrases which may point out a compliance violation.

Utilizing sentiment evaluation and key phrase recognition, you may flag requires human evaluation, prioritizing high-risk interactions and rising audit effectivity.

This technique removes the pressure and potential for human error in comparison with manually checking name recordings, liberating up human reviewers to deal with advanced instances.

It additionally comes with the bonus of monitoring the client expertise. When callers use phrases indicating excessive emotion or stress, it might show you how to detect calls that must be monitored for compliance causes.

Keep Compliance With Nextiva’s Safe Platform

Coaching, document preserving, and fixed studying are essential to sustaining contact heart compliance.

With out these in place, you would be opening your self as much as extra dangers than you bargained for.

Contact heart platforms like Nextiva present safe and dependable communications to each buyer no matter {industry}.

We restrict some performance for HIPAA-compliant accounts to guard non-public affected person information. This helps companies keep in compliance with out making any adjustments.

In current instances, we’ve adjusted the next options:

- Visible voicemail: disabled

- Nextiva App: disabled voicemail replay performance

- Voicemail to e-mail or textual content: disabled

- vFAX: disabled performance permitting the sending of faxes from an e-mail (you may nonetheless view incoming faxes utilizing a safe e-mail hyperlink or by logging into your portal)

Nextiva additionally executes a Enterprise Affiliate Settlement that addresses our coated companies and states the privateness, safety, and breach notification guidelines required for enterprise associates underneath HIPAA.

Due to superior name recording, our strong characteristic set additionally permits PCI DSS compliance. You may document all requires coaching and monitoring and use the Pause/Resume operate so card particulars aren’t recorded.

You may add particular information safety measures and agent workflows due to our intuitive interactive voice recognition builder, ANI, and loads of different options designed to maintain you on observe.

The decision heart answer groups love.

See why high manufacturers use Nextiva to deal with calls at scale. Straightforward to make use of. Quick setup.

[ad_2]