[ad_1]

Do you ever really feel like irrespective of how a lot cash you make or what number of stuff you purchase, you by no means appear to be any happier? You is perhaps caught in what psychologists name the “hedonic treadmill.” It’s like working on a treadmill – you retain transferring, however you by no means actually get wherever.

What’s the Hedonic Treadmill?

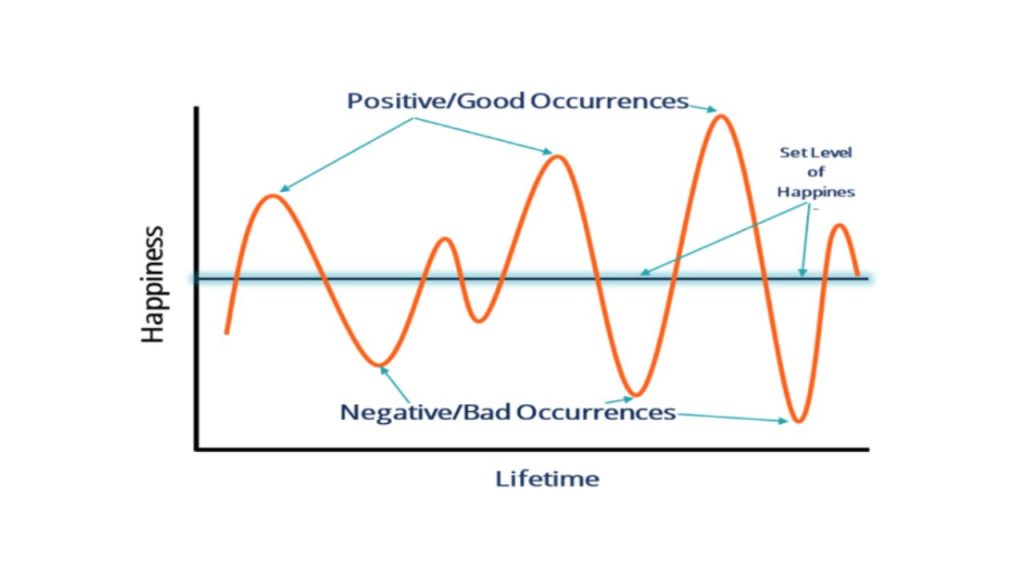

The hedonic treadmill is a psychological phenomenon the place folks persistently return to a comparatively secure degree of happiness, regardless of main constructive or detrimental occasions of their lives. Because of this even when we get a elevate at work or purchase a brand new automotive, we shortly adapt to those modifications and our happiness ranges return to the baseline.

Initially, these occasions might result in a big enhance or lower in happiness, however over time, we are likely to adapt and return to our baseline degree of happiness.

For instance, successful a lottery can carry immense pleasure and pleasure, however because the novelty wears off and we develop into accustomed to our newfound wealth, the preliminary happiness fades, and we return to our earlier degree of contentment. Equally, experiencing a loss or setback might trigger intense emotions of disappointment or despair, however as time passes, we regularly regulate and return to our baseline degree of well-being.

How Does it Have an effect on Our Funds?

The issue with the hedonic treadmill is that it could possibly result in poor monetary choices. We might continuously chase after more cash and possessions in an try to extend our happiness, solely to seek out that it’s by no means sufficient. This relentless pursuit may end up in overspending, accumulating debt, and experiencing monetary stress.

The issue lies in our tendency to adapt to new circumstances and possessions shortly. What initially brings us pleasure and happiness quickly develop into the norm, and we discover ourselves in search of the subsequent buy or monetary milestone to achieve that very same degree of satisfaction. Nonetheless, this cycle of consumption is unsustainable and may result in a downward spiral of economic instability.

Ideas for Breaking Free:

1. Follow Gratitude: As a substitute of specializing in what you don’t have, take time to understand what you do have. Maintaining a gratitude journal may also help you domesticate a extra constructive outlook on life with out counting on materials possessions.

2. Set Significant Targets: Moderately than chasing after fleeting pleasures, set objectives that align together with your values and convey long-term satisfaction. This might embody saving for a visit, investing in your schooling, or donating to a trigger you consider in.

3. Follow Mindfulness: Be current within the second and take note of your ideas and emotions. Mindfulness may also help you develop into extra conscious of your spending habits and forestall impulse purchases pushed by the will for fast gratification.

4. Deal with Experiences Over Issues: Spend money on experiences moderately than materials possessions. Analysis exhibits that experiences are likely to carry extra lasting happiness than shopping for stuff. So as a substitute of shopping for the most recent gadget, contemplate spending your cash on a weekend getaway or a cooking class with buddies.

5. Stay Inside Your Means: It’s essential to dwell inside your means and keep away from evaluating your self to others. Simply because another person has a much bigger home or a fancier automotive doesn’t imply it’s worthwhile to sustain. Deal with what’s actually essential to you and prioritize your spending accordingly.

6. Differentiate Between Wants and Desires: Earlier than making a purchase order, ask your self if it’s one thing you actually want or simply one thing you need within the second. Studying to differentiate between requirements and frivolous indulgences may also help curb impulse spending.

7. Keep away from Comparability with Others: It’s simple to really feel pressured to maintain up with the Joneses, however evaluating your self to others solely fuels the will for extra materials possessions. Focus by yourself monetary objectives and priorities as a substitute of attempting to compete with others.

8. Spend money on Your self: As a substitute of in search of happiness by materials possessions, put money into experiences and actions that promote long-term well-being. Whether or not it’s pursuing a pastime, studying a brand new talent, or investing in your well being, concentrate on actions that present lasting fulfilment.

9. Follow minimalism: Embrace a minimalist way of life by decluttering your belongings and specializing in what actually provides worth to your life. By simplifying your environment, you’ll cut back the will for pointless purchases and domesticate a better sense of contentment with much less.

10. Delay Gratification: Follow delaying gratification by implementing a “cooling-off interval” earlier than making non-essential purchases. This lets you rethink whether or not the merchandise is really value the associated fee and whether or not it aligns together with your long-term objectives.

Conclusion

Breaking free from the hedonic treadmill isn’t simple, however by making acutely aware decisions and prioritizing experiences over possessions, you may defend your funds and discover better satisfaction in life. Bear in mind, true happiness doesn’t come from how a lot cash you could have or what you personal – it comes from inside.

[ad_2]