[ad_1]

Psychology was one in all my favourite topics in class.

It was like getting an instruction handbook for the way folks labored.

A cheat sheet.

Certainly one of my favourite “theories” in psychology is Abraham Maslow’s Hierarchy of Wants.

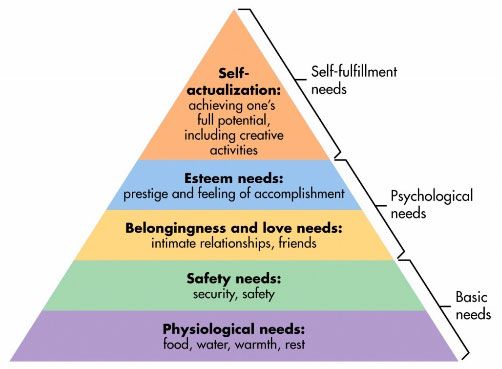

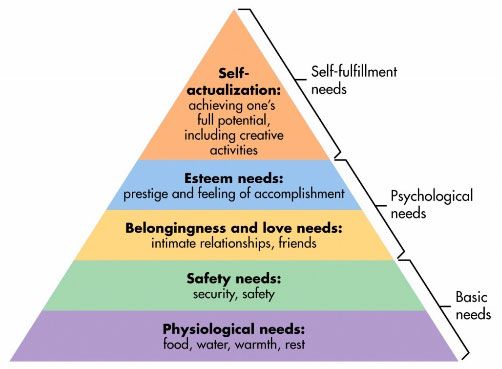

Right here it’s:

It’s a idea of human motivation.

We intention to fulfill the wants on the backside earlier than working our approach up.

You don’t care about status whenever you don’t have meals or water or shelter. When you fulfill your fundamental wants, you begin serious about psychological wants.

(the degrees aren’t this reduce and dry and also you don’t fulfill every stage earlier than transferring up, however the framework remains to be a helpful mannequin)

Maslow’s Hierarchy of Wants is a framework that may enable you perceive the way you spend your cash and your life.

Desk of Contents

How do I exploit the hierarchy of wants

The hierarchy will help clarify the motivation behind why folks behave a sure approach.

Right here’s how you need to use the hierarchy to information you and enable you make higher selections —

Everyone seems to be striving for the achievement of each stage of their hierarchy of wants. The decrease ones have larger priorities, however at our core we’re in search of to satisfy all of them.

Earlier than you commit that subsequent greenback, take into consideration the necessity it’s fulfilling.

Are you seeking to fulfill larger wants at the price of decrease ones?

Are there alternate options which may price much less or fulfill that particular want higher?

Is it even fulfilling the necessity you suppose it’s?

A handbag isn’t only a purse.

Let’s take a quite simple instance – a handbag is only a bag. Functionally, it holds stuff.

In actuality – it does a lot extra.

You should purchase a $20 one from Goal or a $150 one from Coach or a $15,000 one from Louis Vuitton.

Why do some folks purchase the $15,000 model? As a result of it makes them really feel good. It provides them status and it’s the fruit of their labor.

There are individuals who can purchase $15,000 purses however purchase the $20 one as an alternative. It’s not as a result of they’re low-cost however as a result of they don’t affiliate status with a purse. They don’t get $15,000 of worth out of the bag. It doesn’t make them really feel $15,000 good.

The parents who spend that a lot have a motive too. Perhaps they purchase these purses so they seem extra interesting as they search out associates and intimate relationships. Perhaps they do it as a result of they really feel they deserve it – so it’s a reward for previous habits. Regardless of the case, it’s not “silly.” It merely is what it’s.

This is applicable to the whole lot – vehicles, homes, garments, jewellery, … this listing by no means ends.

The Prime Directive of Private Finance is that you need to “Keep away from committing future funds to spending obligations; commit them to saving obligations.”

Earlier than you commit your funds, contemplate the aim and whether or not you’d be higher off making a commerce as an alternative.

If a purse is unrelatable, how about shelter?

A home is a main instance of how understanding the hierarchy is so vital and the way it intersects with the Prime Directive of Private Finance.

A home hits each layer of the hierarchy of wants:

- Physiological wants: The obvious, a house supplies bodily heat and relaxation.

- Security wants: Your private home is your sanctuary, a spot the place you may lock the doorways – you’re feeling protected and safe.

- Belongingness and love wants: Whenever you put down roots, it’s far simpler to construct lasting relationships.

- Esteem wants: Householders are seen as having extra status than renters. Proudly owning your private home is a badge of honor. A nicer dwelling is best than a much less good dwelling.

- Self-actualization wants: A house could not test off this want nevertheless it lets you pursue it, maybe providing you with a spot throughout the dwelling which you could be artistic – a workshop, a studio, one thing of that nature.

And homes most actually have luxurious variations. You may purchase a small home or you should buy an enormous one. Or you should buy a cottage within the woods. Or stay in a transformed camper van!

They fulfill every of the degrees to various levels however can have broadly completely different prices.

Warren Buffett has lived in the identical home since 1958. It’s a pleasant dwelling in Omaha, NE that he bought for $31,500. It has 5 bedrooms and a couple of.5 baths. He’s value ~135 billion {dollars}. He might simply purchase many many MANY lavish properties anyplace he needs and never even discover it.

However he doesn’t and there’s an excellent motive – it doesn’t matter to him.

He’s nice with the equal of a Coach purse, he doesn’t want the Louis Vuitton. He doesn’t want or care concerning the status related to it. He has it happy elsewhere in his life.

As you go to purchase your home, are you shopping for that a lot home since you want that a lot house or are you making an attempt to fulfill one other want? Are you committing to fifteen/30 years of funds to get one thing you possibly can get in a $1,000 purse? 😆

How debt flips the hierarchy upside-down

Whenever you introduce debt, issues get ugly.

If you wish to purchase a $15,000 purse and will pay money, go for it!

There may be nothing mistaken with satisfying your want for status. It’s human. Anybody who says in any other case is just signaling they don’t care about purses, nothing extra.

All of us need status, whether or not we admit it or not.

For those who put that buy on a bank card (and carry a stability), it turns into a giant monetary downside.

Functionally, debt lets you borrow cash out of your future self. However your future self doesn’t get curiosity funds, she or he simply will get to make use of no matter you’re shopping for a little bit bit earlier.

With debt, folks can spend past their means. That is nice whenever you wish to make put money into your self and your monetary system. A mortgage provides you entry to a extra predictable residing scenario. A automobile mortgage provides you entry to a automobile. A scholar mortgage provides you entry to larger training and talent constructing.

However debt introduces issues. Debt can be utilized on “wants” as simply as they can be utilized on investments.

Individuals usually stay past their means as a result of they need to fulfill one in all their larger wants. The engine of their monetary life, their skill to earn, hasn’t elevated however they’ve already borrowed towards their future self.

Debt is harmful whenever you apply it to satisfying a better want as a result of it’s very costly. In case your incomes skill doesn’t additionally enhance, debt means you’ve bumped up the incline on the treadmill of life.

Whenever you use it for an funding in your incomes potential, like training, you borrow towards the long run however you additionally enhance your incomes potential. In that scenario, debt could be a useful device.

In both case, the query you need to reply is – “what want am I satisfying?”

It’s your cash, spend it nevertheless you need

Earlier than you suppose it is a “spend solely on perform!” submit – it’s not.

Take me for instance – I actually take pleasure in holidays. I take pleasure in visiting new locations, having new experiences, and residing a life that isn’t mine if just for a short while. (the brand new locations factor is why a timeshare isn’t for me)

Holidays are laborious to defend financially as a result of they create nothing tangible. They create recollections (recollections admire!) nevertheless it’s not like a bag. They don’t do something… however I like them nonetheless.

It’s your cash and you’ll spend it nevertheless you need. Some folks spend extra on meals. Some folks spend extra on safety. Some folks spend extra on relationships, status, no matter!

You made that cash and also you don’t want anybody else’s permission. (actually not mine!)

You want permission out of your future self.

You should be sincere to the true motivation. Corporations spend billions a 12 months on promoting to attraction to those wants, educate your self so you may adequately defend your self.

In case you are sincere with your self, spend with out guilt. You earned it.

The true problem after you may have “sufficient”

Spending is simply half one in all utilizing the hierarchy – incomes is a component two.

When you’re making simply sufficient to fulfill the essential wants, you don’t have further time and psychological house to consider the work. You’re too busy making an attempt to make sufficient cash to pay for lease, meals, gasoline, and different fundamental wants.

As your earnings grows, as your investments accrue, and also you escape monetary gravity, you’ll begin your work and serious about whether or not it satisfies self-fulfillment and psychological wants.

New retirees face these challenges. Whether or not they’re retired after a long time of labor or they’re athletes who retire from skilled sports activities of their thirties or forties – it is a tough transition.

This is the reason so many individuals have encore careers or enter into philanthropy – they nonetheless wish to be productive, they don’t want more cash, however they should fulfill these larger wants.

If this describes you, remember that what you need isn’t more cash however one thing else.

Examine the hierarchy, the reply could also be there.

[ad_2]