[ad_1]

You might have contributed to a Roth IRA after which realized later within the yr that you’d exceed the revenue restrict. You recharacterized the Roth IRA contribution as a Conventional IRA contribution and transformed it to Roth once more earlier than the top of the yr. Your IRA custodian despatched you two 1099-R types, one for the recharacterization and one for the conversion. This publish reveals you easy methods to put them into TurboTax.

For those who had achieved the recharacterizing and changing within the following yr, you would need to cut up the tax reporting into two years by following Backdoor Roth in TurboTax: Recharacterize & Convert, 1st Yr and Backdoor Roth in TurboTax: Recharacterize & Convert, 2nd Yr. Now since you caught the issue quickly sufficient earlier than the top of the yr, you may deal with all of it in the identical yr by following this information.

Right here’s the instance state of affairs we’ll use on this information:

You contributed $6,500 to a Roth IRA for 2023 in 2023. You realized that your revenue can be too excessive later in 2023. You recharacterized the Roth contribution for 2023 as a Conventional contribution. The IRA custodian moved $6,600 out of your Roth IRA to your Conventional IRA as a result of your unique $6,500 contribution had some earnings. The worth elevated once more to $6,700 whenever you transformed it to Roth earlier than December 31, 2023. You acquired two 1099-R types, one for $6,600 and one other for $6,700.

For those who didn’t do any of those recharacterizing and changing, please comply with our information for a “clear” backdoor Roth in How To Report Backdoor Roth In TurboTax (Up to date).

For those who’re married and each you and your partner did the identical factor, it is best to comply with the steps beneath as soon as for your self and as soon as once more to your partner.

Use TurboTax Obtain

The screenshots beneath are from TurboTax Deluxe downloaded software program. The downloaded software program is manner higher than on-line software program. For those who haven’t paid to your TurboTax On-line submitting but, you should buy TurboTax obtain from Amazon, Costco, Walmart, and lots of different locations and change from TurboTax On-line to TurboTax obtain (see directions for easy methods to make the change from TurboTax).

1099-R for Recharacterization

We deal with the 1099-R type for the recharacterization first. This 1099-R type has a code “N” in Field 7.

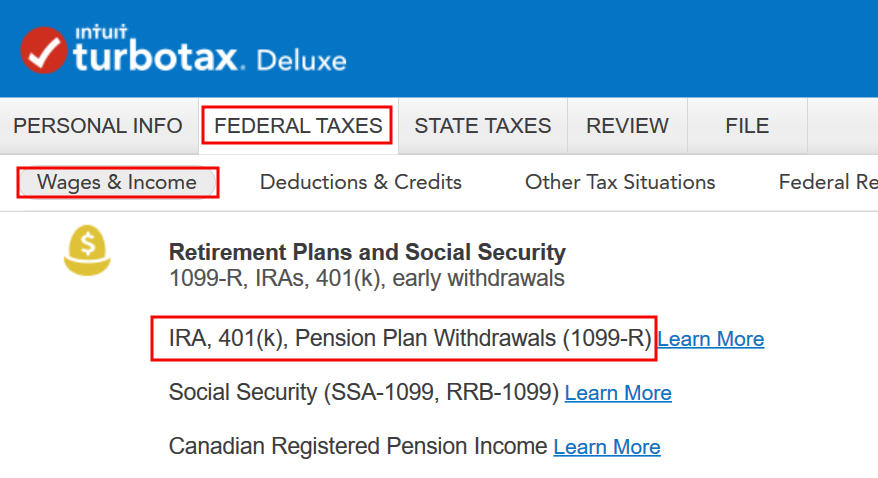

Go to Federal Taxes -> Wages & Revenue -> IRA, 401(okay), Pension Plan Withdrawals (1099-R).

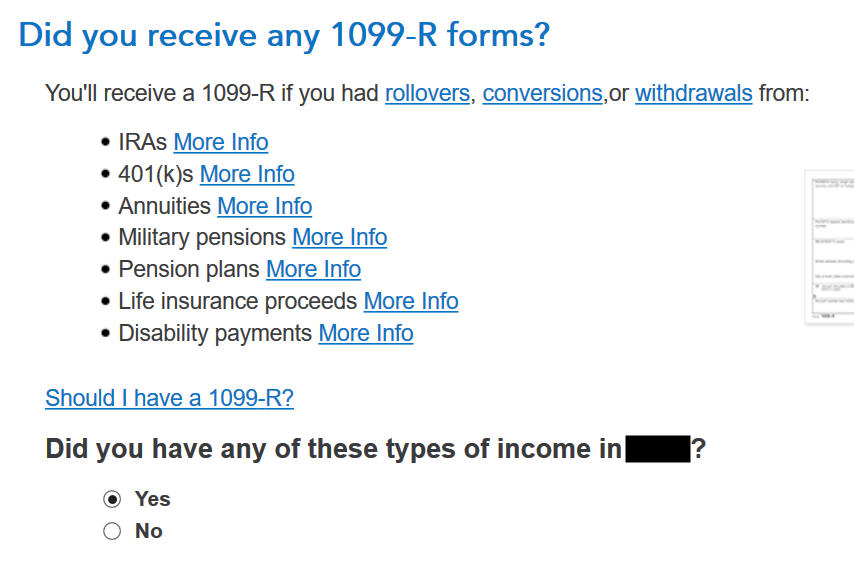

Verify that you’ve acquired a 1099-R type. Import the 1099-R should you’d like. I’m selecting to sort it myself.

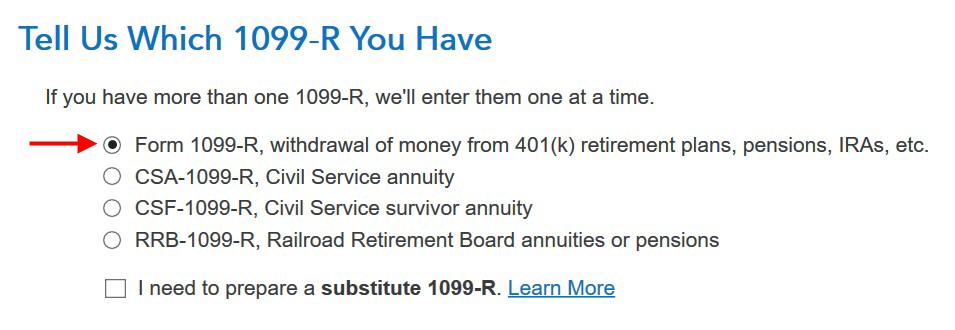

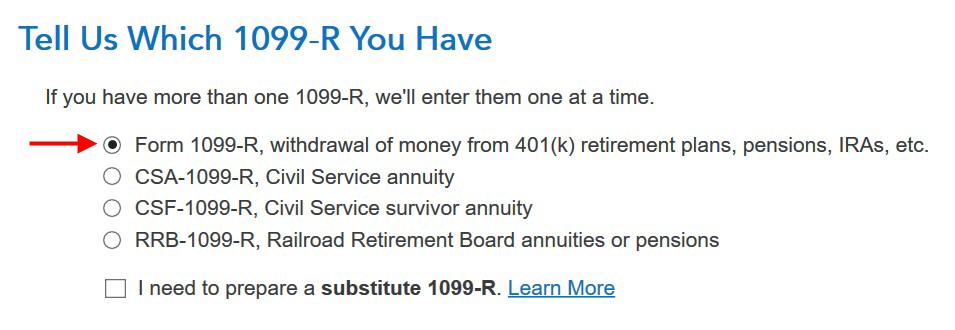

It’s a daily 1099-R.

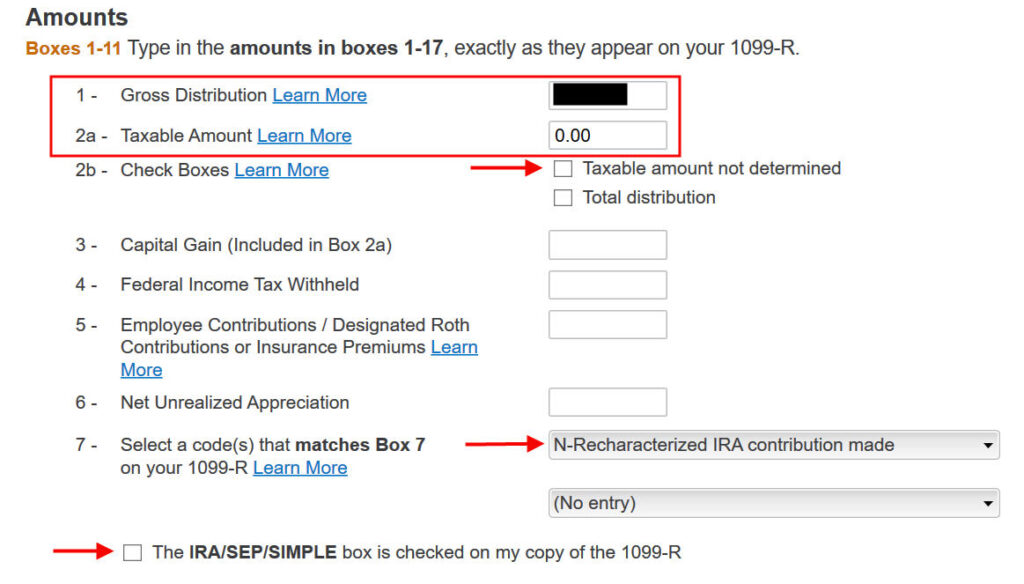

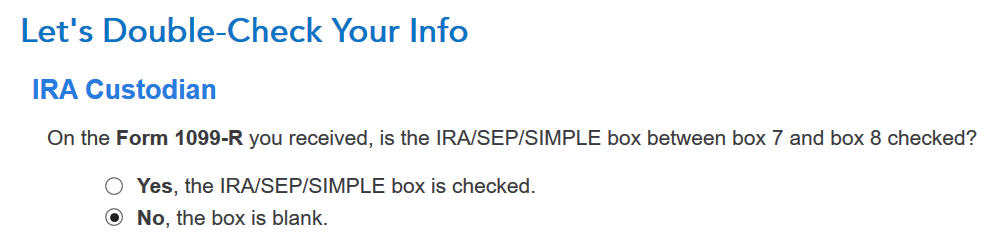

The 1099-R type for the recharacterization reveals the quantity moved from the Roth IRA to the Conventional IRA in Field 1. The taxable quantity is 0 in Field 2a and the “Taxable quantity not decided” field isn’t checked. The code in Field 7 is “N” and the “IRA/SEP/SIMPLE” field might or will not be checked. It isn’t checked in our pattern type.

That field is clean in our 1099-R, and that’s OK.

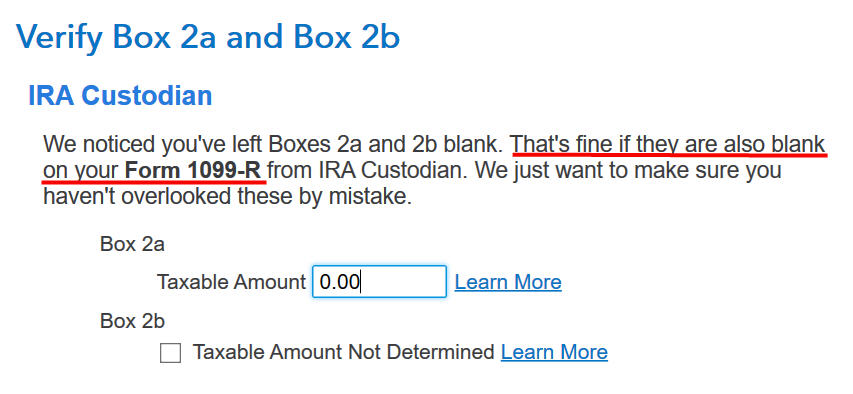

It’s regular to see zero in Field 2a and clean in Field 2b on this 1099-R type. TurboTax simply needs to double-check.

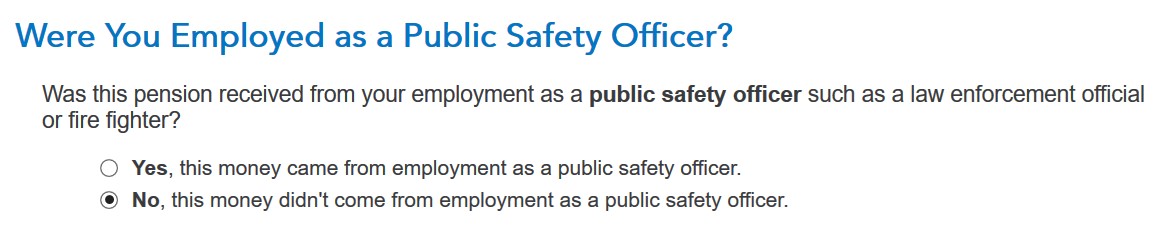

Not a Public Security Officer.

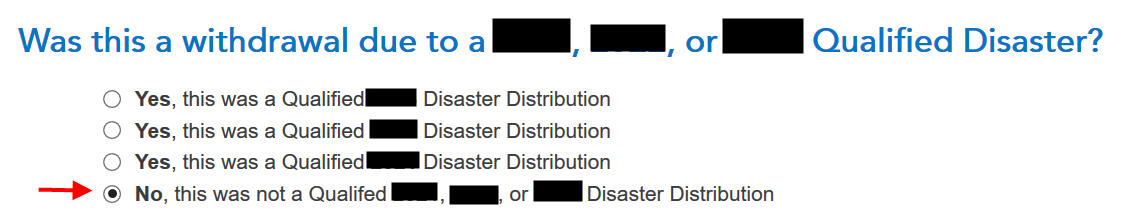

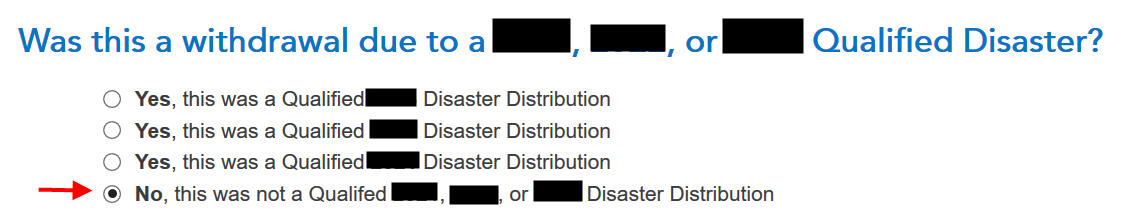

Not as a result of a catastrophe.

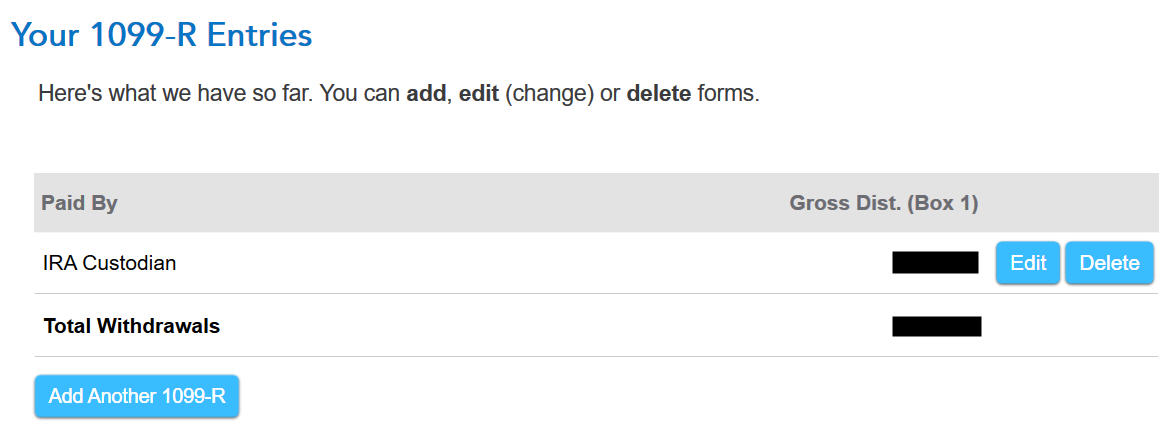

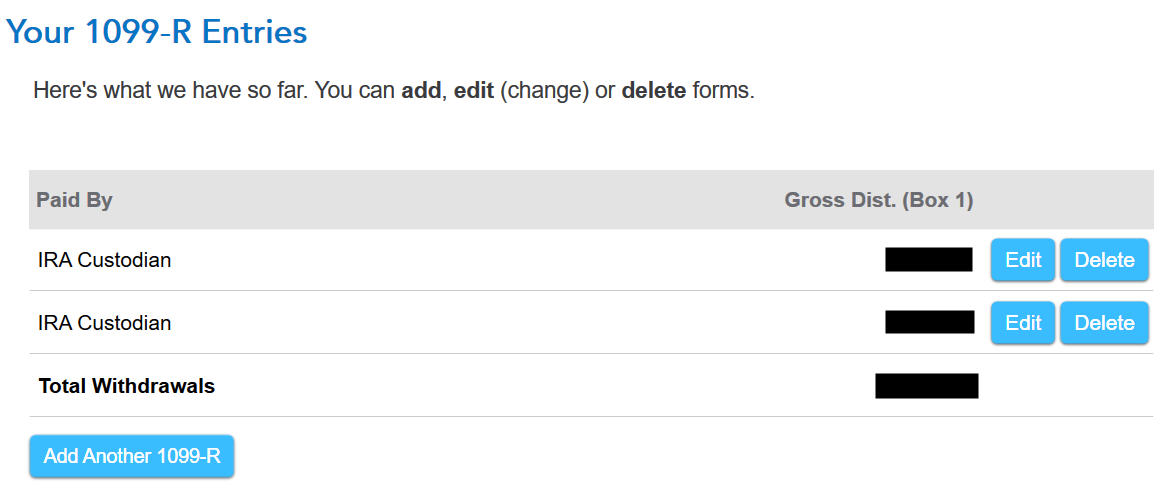

You’re achieved with the 1099-R type for the recharacterization. Click on on “Add One other 1099-R” so as to add the one for the conversion should you don’t have each 1099-R types imported already.

1099-R for Conversion

This 1099-R type can also be a daily 1099-R.

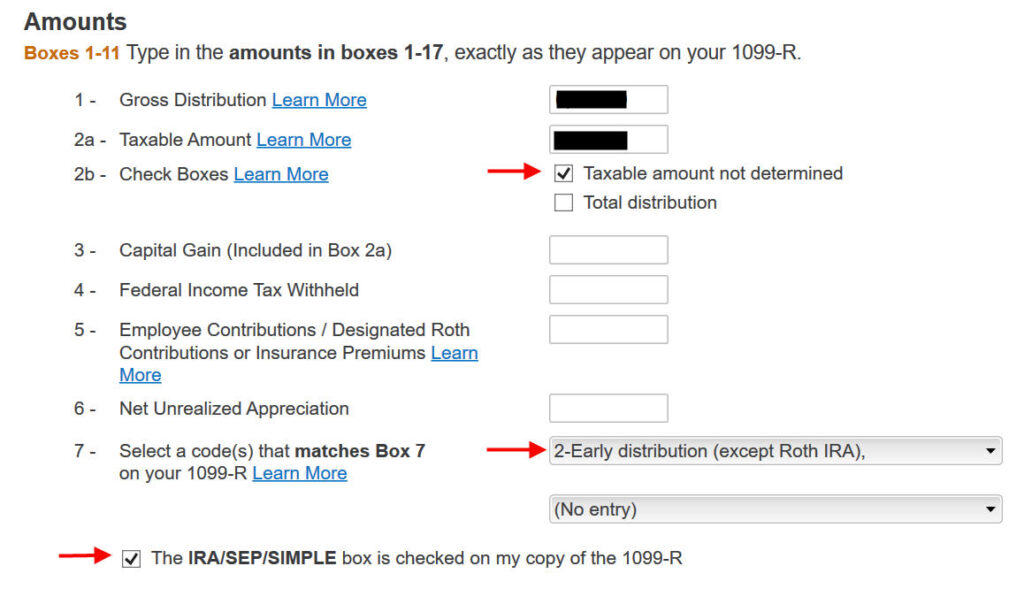

It’s regular to see the conversion reported in Field 2a because the taxable quantity when Field 2b is checked to say “Taxable quantity not decided.” The code in Field 7 is ‘2‘ whenever you’re underneath 59-1/2 or ‘7‘ whenever you’re over 59-1/2. The “IRA/SEP/SIMPLE” field is checked on this 1099-R type for the conversion.

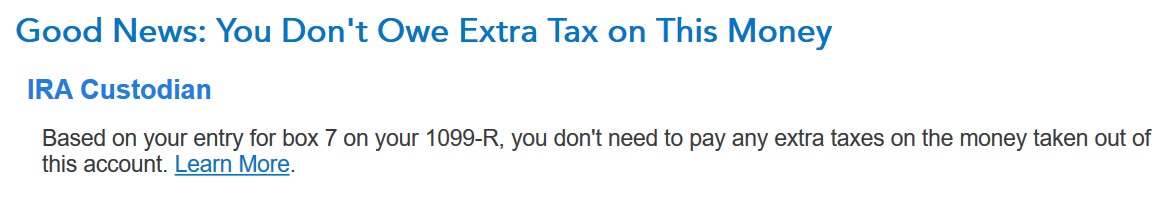

It says that you simply don’t owe further tax on this cash however your refund meter drops. Don’t panic. It’s regular and solely non permanent.

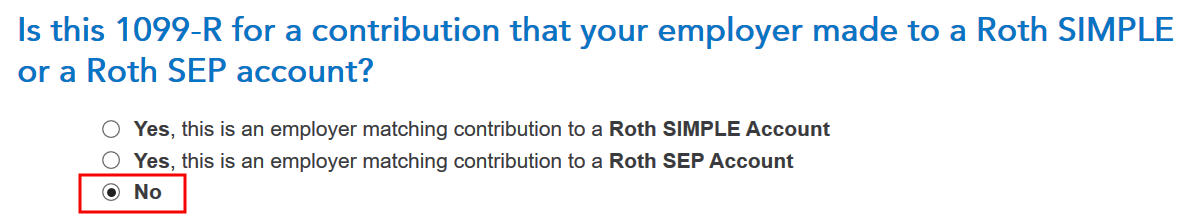

It’s not a Roth SIMPLE or a Roth SEP.

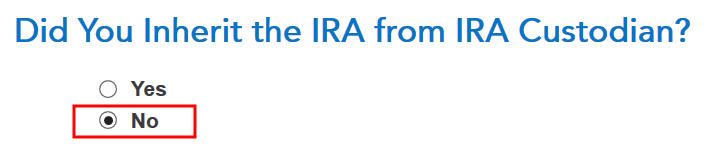

Didn’t inherit it.

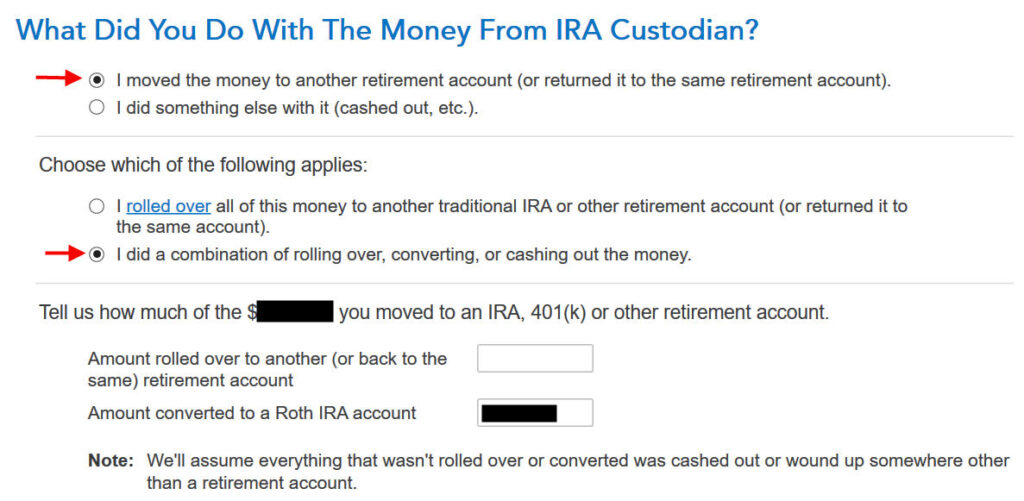

Transformed to Roth

First click on on “I moved …” then click on on “I did a mixture …” Enter the quantity you transformed to Roth within the field. It’s $6,700 in our instance. Don’t select the “I rolled over …” choice. A rollover means Conventional-to-Conventional. Changing to Roth isn’t a rollover.

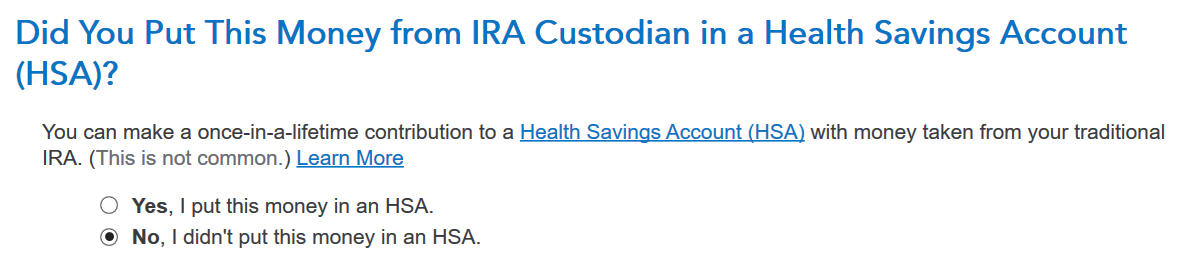

Didn’t put it in an HSA.

Not as a result of a catastrophe.

Now the 1099-R abstract contains each 1099-R types. Preserve going by clicking on “Proceed.”

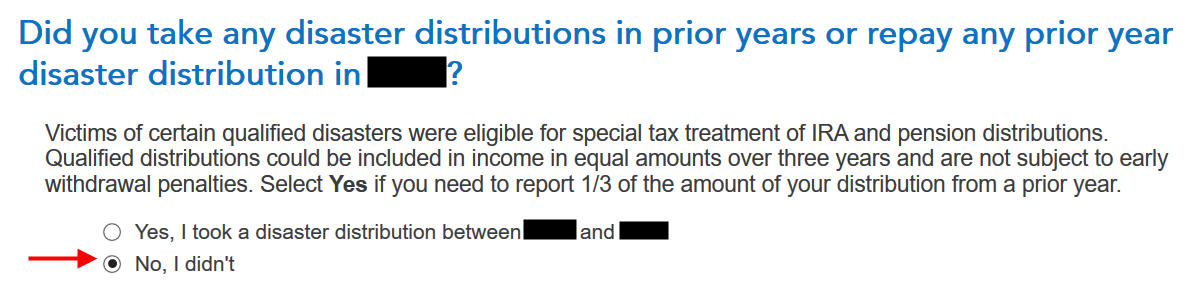

No catastrophe distributions.

Foundation

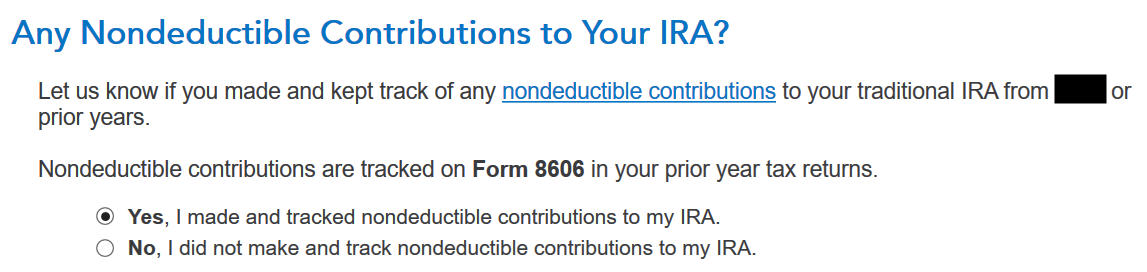

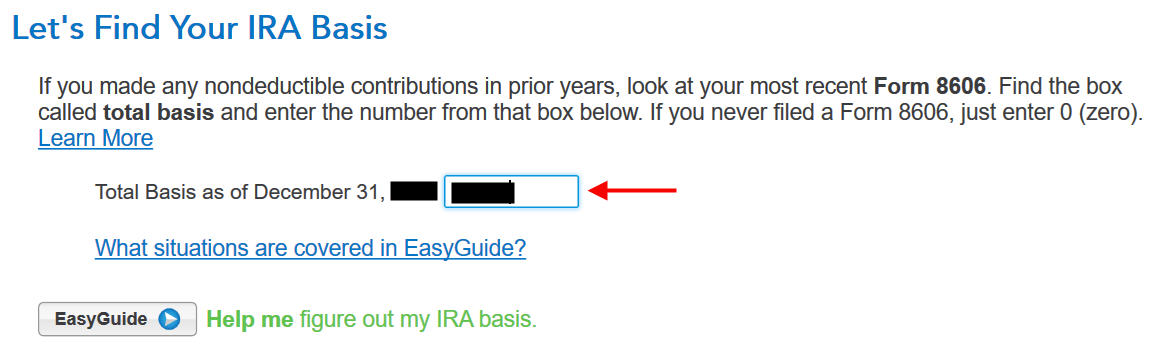

You may reply “No” right here however answering “Sure” with a 0 has the identical impact and it lets you right earlier mistaken entries.

This must be 0 should you hadn’t made any nondeductible contribution to a Conventional IRA earlier than. For those who had, get the worth out of your final yr’s Kind 8606 Line 14.

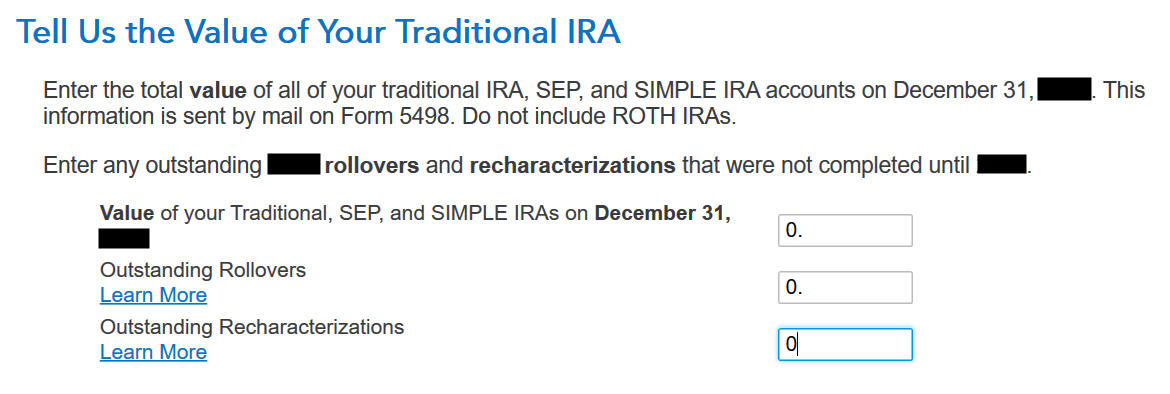

These are usually all zero should you transformed the whole lot. For those who had a number of {dollars} left within the account from earnings posted after you transformed, enter the worth out of your year-end assertion within the first field.

The refund meter continues to be quickly depressed. It’ll come again solely after we enter the recharacterized Roth IRA contribution.

Recharacterized Contribution

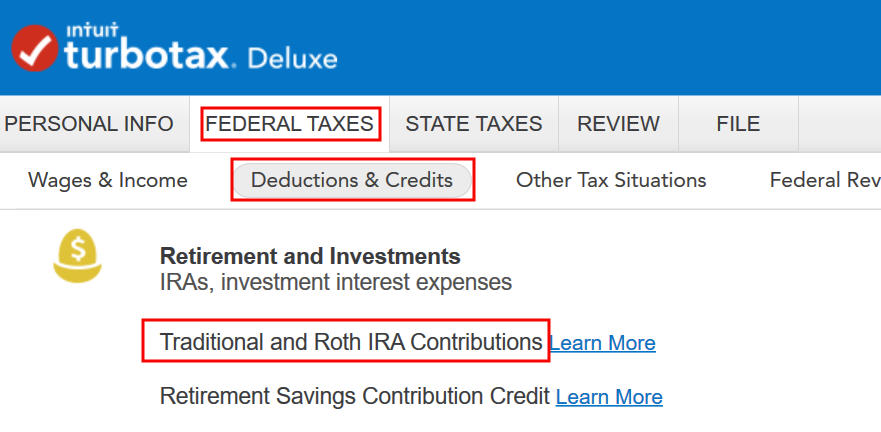

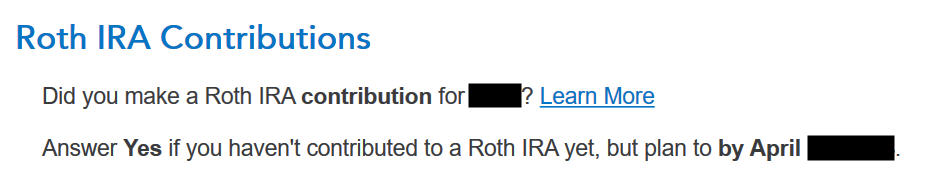

Go to Federal Taxes -> Deductions & Credit -> Conventional and Roth IRA Contributions.

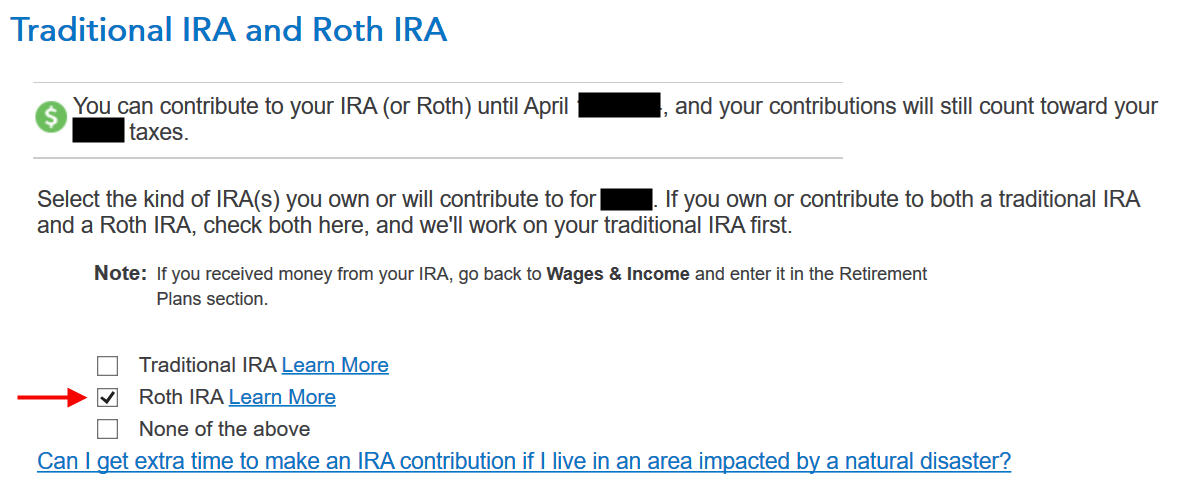

Verify the field for Roth IRA since you initially contributed to a Roth IRA.

We already checked the field for Roth IRA however TurboTax simply needs to verify.

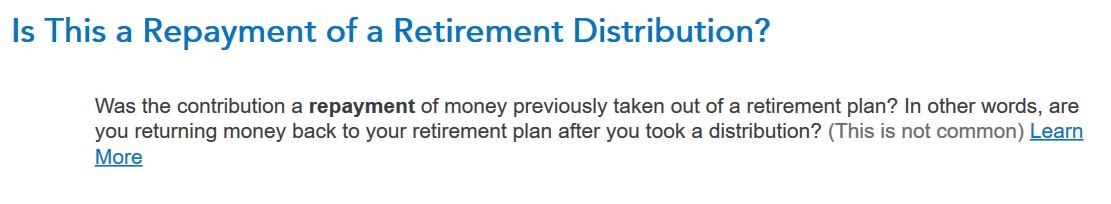

It was not a compensation of a retirement distribution.

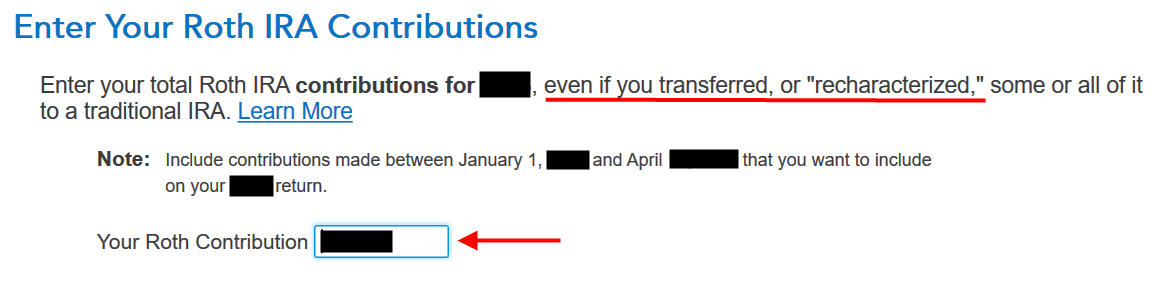

Enter the quantity of your unique Roth contribution. It was $6,500 in our instance.

Recharacterized

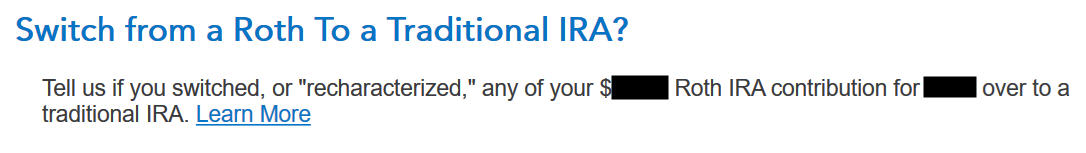

Now we confess that we recharacterized the contribution as a Conventional IRA contribution. Reply Sure right here.

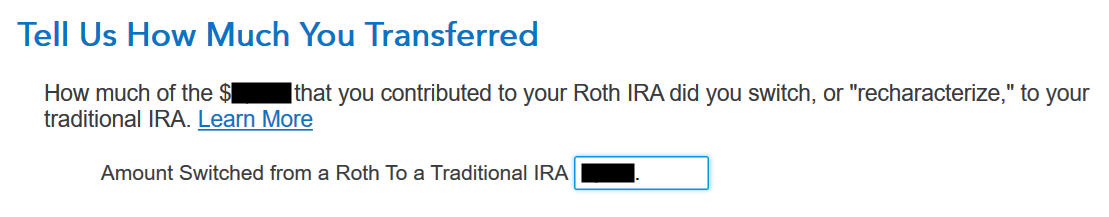

The quantity right here is relative to the unique contribution quantity. For those who recharacterized the entire thing, enter $6,500 in our instance, not $6,600 which was the quantity with earnings that the IRA custodian moved into the Conventional IRA.

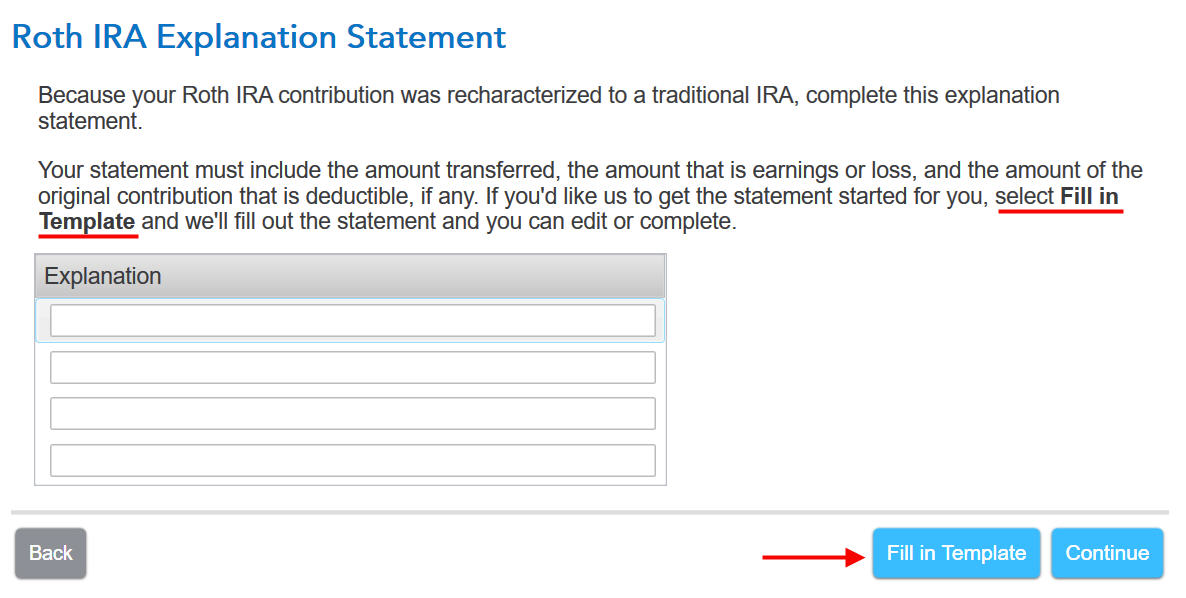

The IRS needs an announcement to elucidate the recharacterization. Click on on “Fill in Template.”

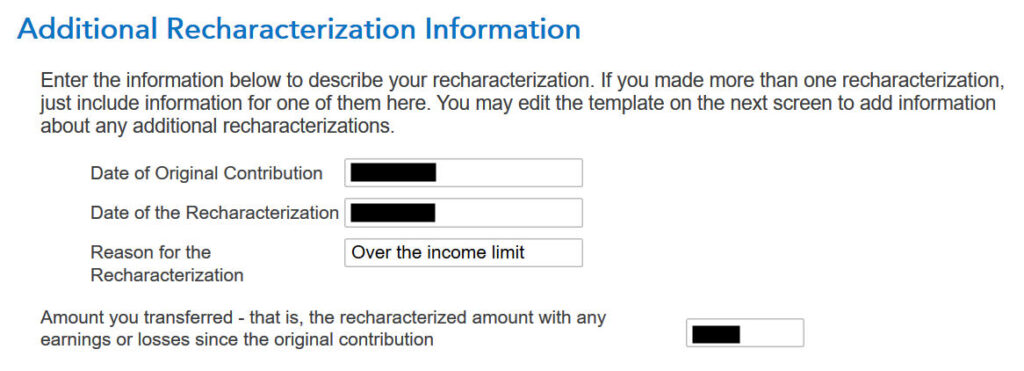

Fill within the dates of your unique contribution and your recharacterization. The quantity within the final field contains earnings. It’s $6,600 in our instance.

Roth Foundation

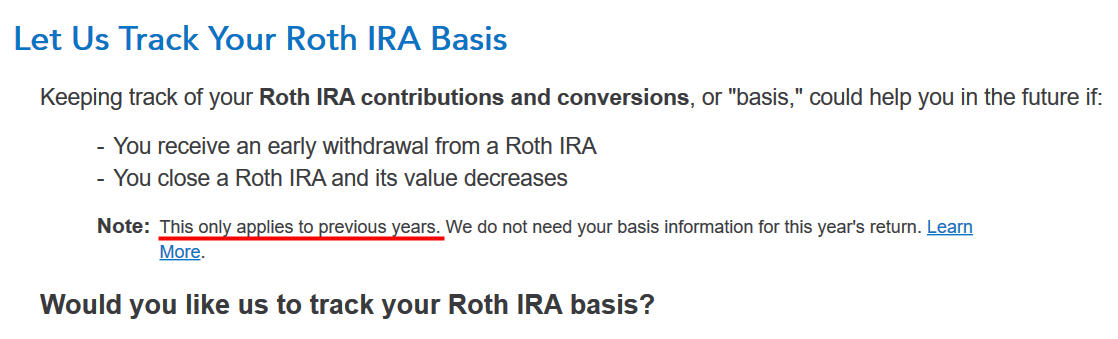

For those who take up this provide from TurboTax to trace your Roth IRA foundation, it’s going to ask you questions on earlier years, which is extra hassle than it’s value to me. I answered No.

You don’t want to trace your Roth IRA foundation should you’re planning to withdraw out of your Roth account solely after age 59-1/2 and after you’ve had your first Roth IRA for 5 years. See Roth IRA Withdrawal After 59-1/2 in TurboTax.

No extra contributions.

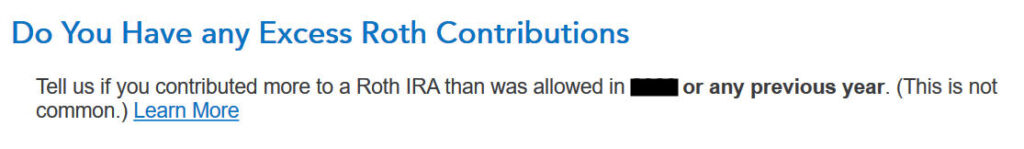

Make It Nondeductible

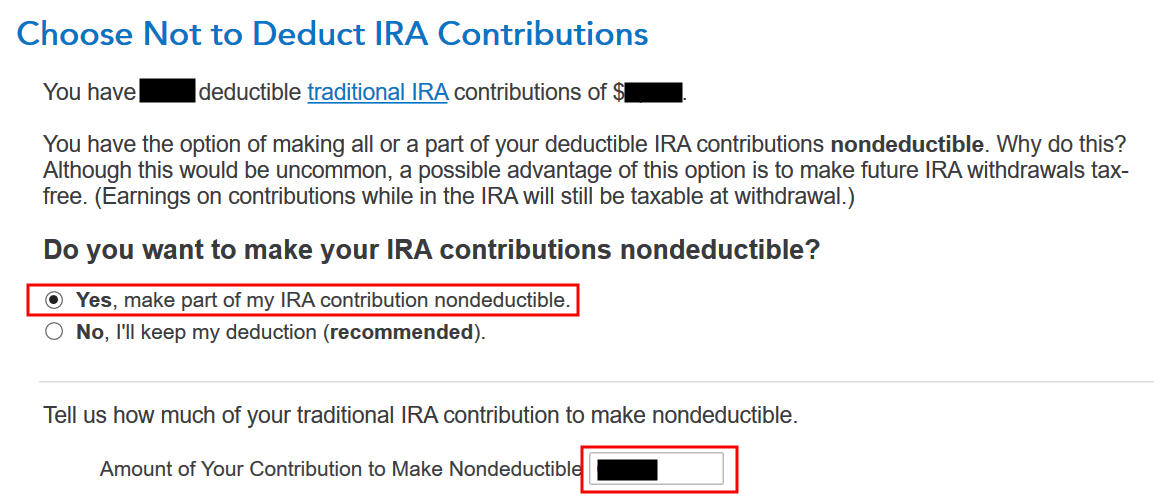

TurboTax reveals this solely when it sees your revenue qualifies for a deduction. You’ve got the choice to take the deduction or decline the deduction. Taking the deduction will make your conversion taxable, which can also be OK as a result of it creates a wash. It’s less complicated should you make your full contribution nondeductible after which your Roth conversion isn’t taxable. Enter the quantity of your accessible deductible contribution within the final field. It’s $6,500 in our instance.

Your Conventional IRA deduction is zero, which is OK as a result of it makes your Roth conversion not taxable.

Taxable Revenue

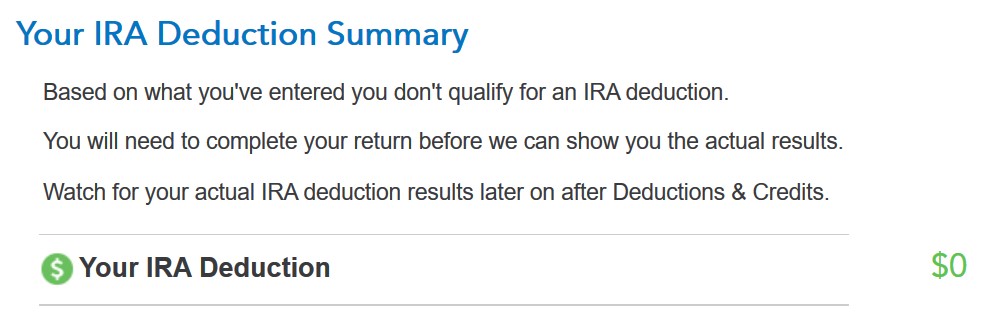

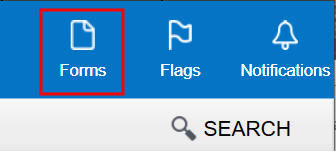

Let’s take a look at how all these present up in your tax return. Click on on “Types” on the highest proper.

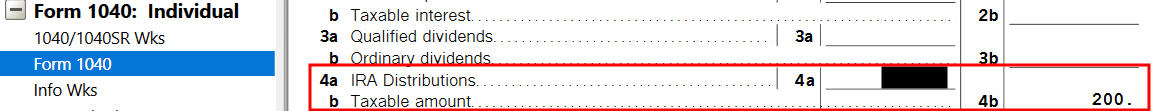

Discover Kind 1040 within the left navigation panel. Scroll up or down on the best to seek out strains 4a and 4b. Line 4a reveals the sum of your two 1099-R types. It’s $13,300 in our instance. That is regular. Line 4b reveals that solely $200 is taxable. That’s the earnings between the time you contributed to your Conventional IRA and the time you transformed it to Roth.

Once you’re achieved analyzing the shape, click on on Step-by-Step on the highest proper to return to the interview.

Swap to Clear Backdoor Roth

You averted having to separate your IRA contribution and Roth conversion in two totally different tax returns by recharacterizing in the identical yr and changing earlier than December 31. Nonetheless, you needed to do the additional work along with your IRA custodian and comply with all these steps on this information whenever you do your taxes.

It’s significantly better to go along with a “clear” backdoor Roth from the get-go. If there’s any chance that your revenue will probably be over the restrict once more, merely contribute to a Conventional IRA for 2024 in 2024 and convert it to Roth in 2024. You’re allowed to do a clear backdoor Roth even when your revenue finally ends up beneath the revenue restrict for a direct contribution to a Roth IRA. It’s a lot less complicated than the complicated recharacterize-and-convert maneuver. Then you definately solely must comply with our information for a clear backdoor Roth in How To Report Backdoor Roth In TurboTax.

Say No To Administration Charges

In case you are paying an advisor a share of your property, you might be paying 5-10x an excessive amount of. Discover ways to discover an unbiased advisor, pay for recommendation, and solely the recommendation.

[ad_2]