[ad_1]

A lengthy field unfold commerce earns a bit of greater than shopping for Treasuries or CDs. A brief field unfold commerce offers you a mortgage at price. If you happen to commerce field spreads, whether or not lengthy or brief, you’ll must report taxes on these trades.

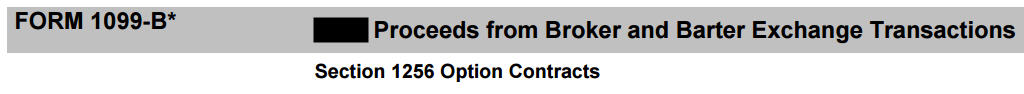

Type 1099-B

Closed contracts generate realized features and losses. Open contracts on the finish of the 12 months are “marked to market” and also you pay taxes on any unrealized features and losses as much as that time.

The dealer will embrace the mandatory data on a 1099-B type. The 1099-B type could also be part of the dealer’s consolidated 1099 type package deal. I’m utilizing the 1099-B type from Constancy for example. The shape from a unique dealer works equally.

Constancy studies field unfold contracts in three sub-sections in its consolidated 1099 package deal. Discover the heading “Part 1256 Choice Contracts” beneath “Type 1099-B 20xx Proceeds from Dealer and Barter Alternate Transactions.”

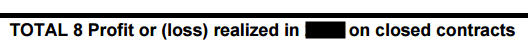

Constancy offers a complete realized achieve or loss after an in depth itemizing of all of the closed contracts.

“Complete 8” refers to Field 8 on the 1099-B. An inventory of unrealized achieve or loss on open contracts as of 12/31 of the prior 12 months seems subsequent.

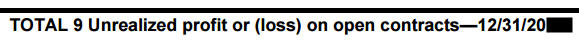

“Complete 9” refers to Field 9 on the 1099-B. If that is the primary 12 months you traded field spreads, this part is empty and the overall is zero. Lastly, you may have a list of unrealized features or losses on open contracts as of 12/31.

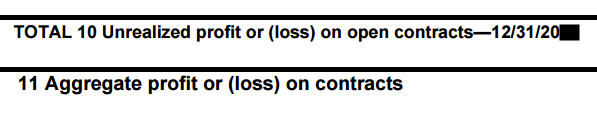

“Complete 10” refers to Field 10 on the 1099-B. The Field 10 itemizing and whole this 12 months will develop into the Field 9 itemizing and whole subsequent 12 months. The Field 11 quantity “combination revenue or loss on contracts” is calculated as:

Realized This Yr (Field 8) – Unrealized Prior Yr (Field 9) + Unrealized This Yr (Field 10)

You first cut back the realized features by the unrealized features you already paid taxes on the earlier 12 months. Then you definately add the unrealized features on contracts you held open as of December 31.

This Field 11 quantity is the crucial information level in your taxes on field unfold trades. If you happen to import 1099 varieties into tax software program, the numbers in Packing containers 8 via 11 might not come via. My import from Constancy didn’t convey them over. I needed to enter the quantity into the software program by hand.

Right here’s put the knowledge from the dealer into tax software program TurboTax, H&R Block, and FreeTaxUSA.

TurboTax

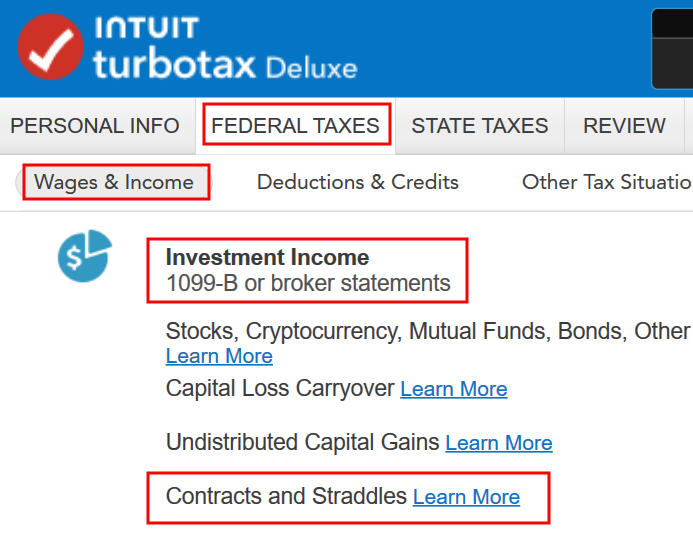

Go to “Federal Taxes” -> “Wages & Earnings.” Discover “Contracts and Straddles” within the “Funding Earnings” part in TurboTax. Click on on “Begin.”

Field spreads fall beneath Part 1256 contracts. Reply “Sure.”

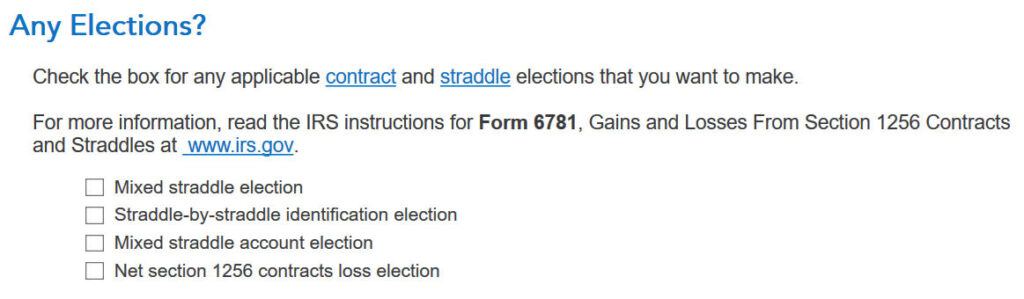

Maintain it easy and depart all the pieces clean right here.

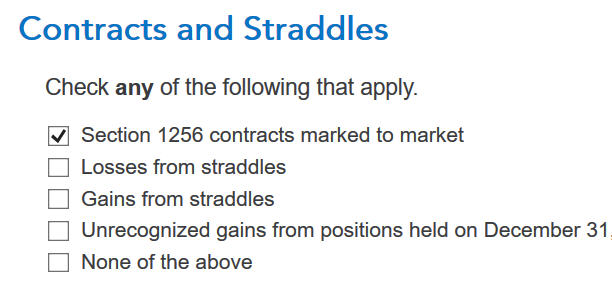

Solely verify the primary field “Part 1256 contracts marked to market” except you even have one thing else apart from field spreads.

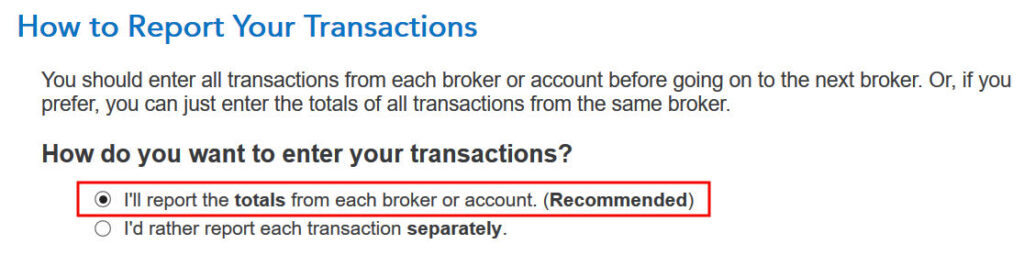

Take the really useful strategy to report the totals from every dealer.

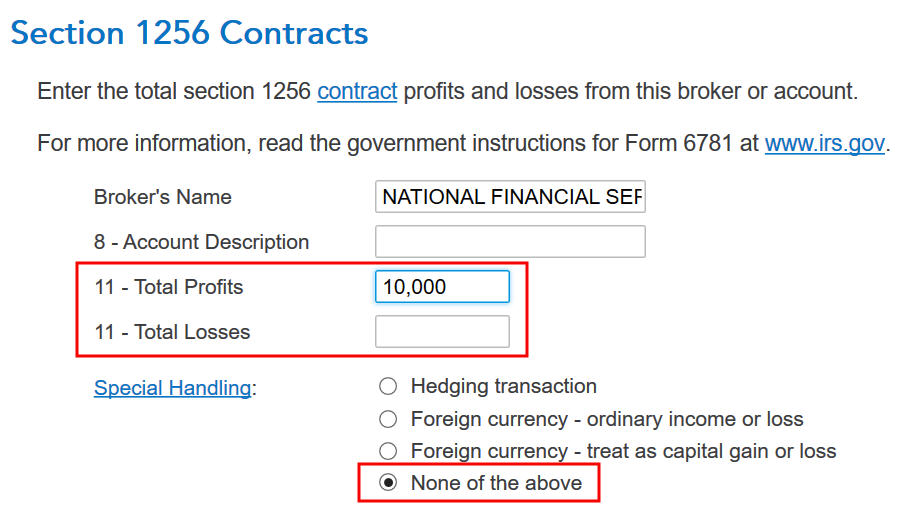

Enter the dealer’s title as proven on the 1099-B type. If Field 11 exhibits a revenue, put it within the Complete Earnings field. If it exhibits a loss, put it within the Complete Losses field as a constructive quantity. Particular Dealing with defaults to “Not one of the above.” Maintain it that approach.

You’re completed with one dealer. Click on on “Add” and repeat when you additionally traded field spreads at one other dealer.

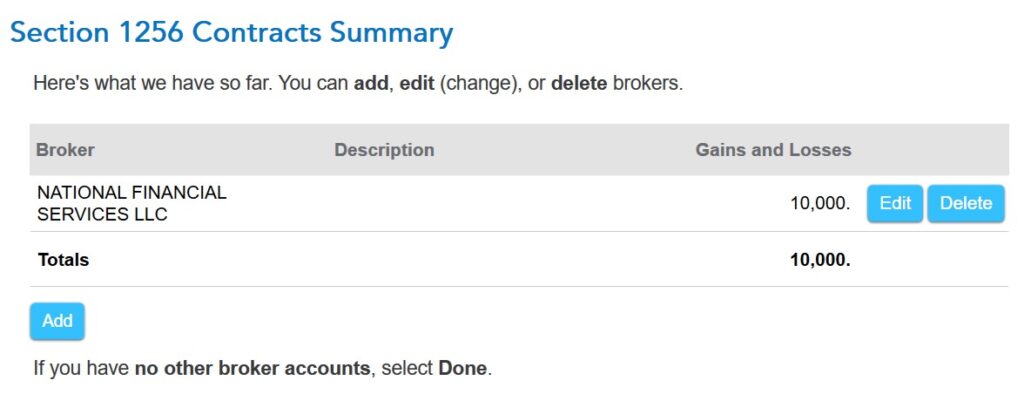

Earlier than you click on on “Completed” on the “Part 1256 Contracts Abstract” display screen, let’s see how the overall revenue or loss exhibits up on the tax return.

Click on on “Kinds” on the prime.

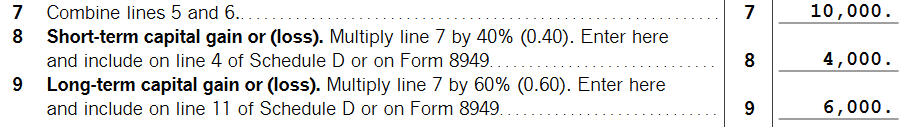

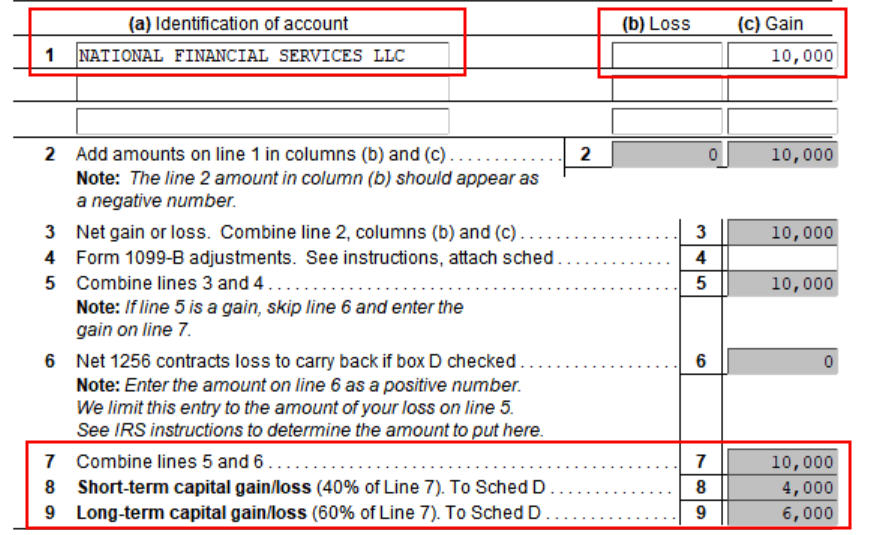

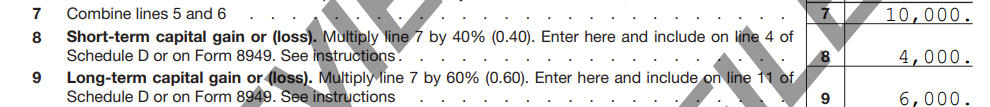

If Type 6781 doesn’t open mechanically, discover it within the record of varieties on the left. Scroll down on the suitable to Strains 7 – 9. You see right here that the overall revenue from field spreads is damaged down as 40% short-term capital achieve and 60% long-term capital achieve.

Click on on “Step-by-Step” on the prime to return to the interview.

H&R Block

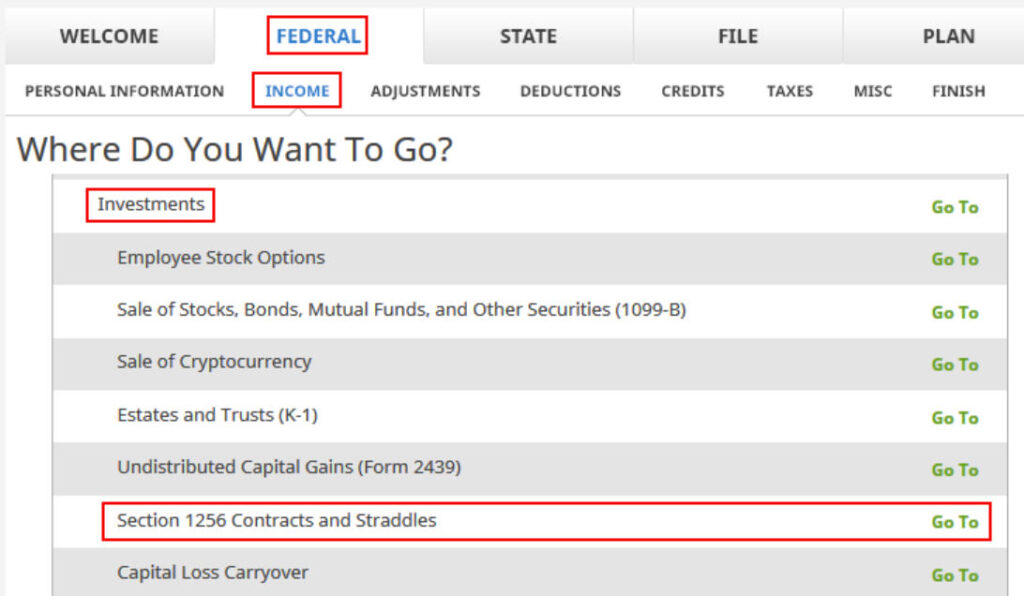

In H&R Block tax software program, click on on Federal -> Earnings. Scroll down to seek out “Part 1256 Contracts and Straddles” within the Investments part.

H&R Block asks you whether or not you had any open contracts as of December 31. You have to reply “Sure” right here even when you didn’t have any open contracts as of December 31 as a result of H&R Block will finish the interview abruptly when you reply “No.”

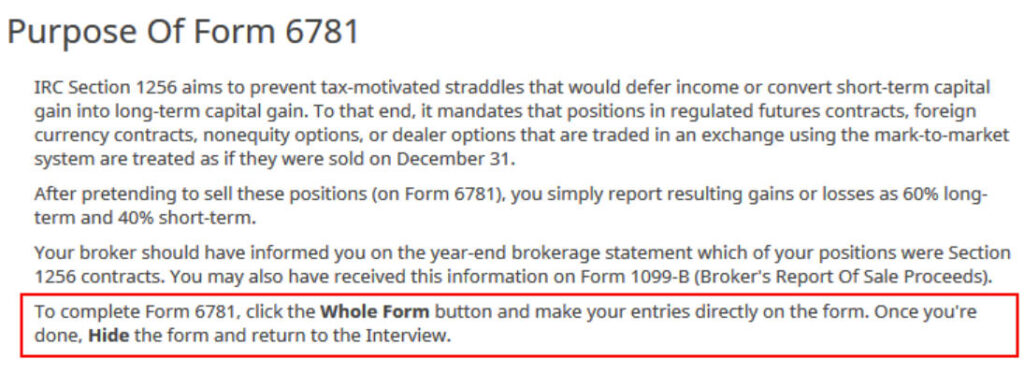

H&R Block goes into the lazy mode once more. It needs you to fill out Type 6781 immediately your self with out a lot steerage. Click on on “Complete Type” to broaden the shape under.

Fortunately the shape isn’t too difficult if solely you recognize what to do with it. Put the title of the dealer from the 1099-B in Line 1 column (a). If the quantity from Field 11 of the 1099-B (“combination revenue or loss on contracts“) is a loss, put it in Line 1 column (b) as a constructive quantity. If it’s a revenue, put it in Line 1 column (c).

The remainder of the traces calculate mechanically. You see the mixture revenue is damaged into 40% short-term capital achieve and 60% long-term capital achieve.

FreeTaxUSA

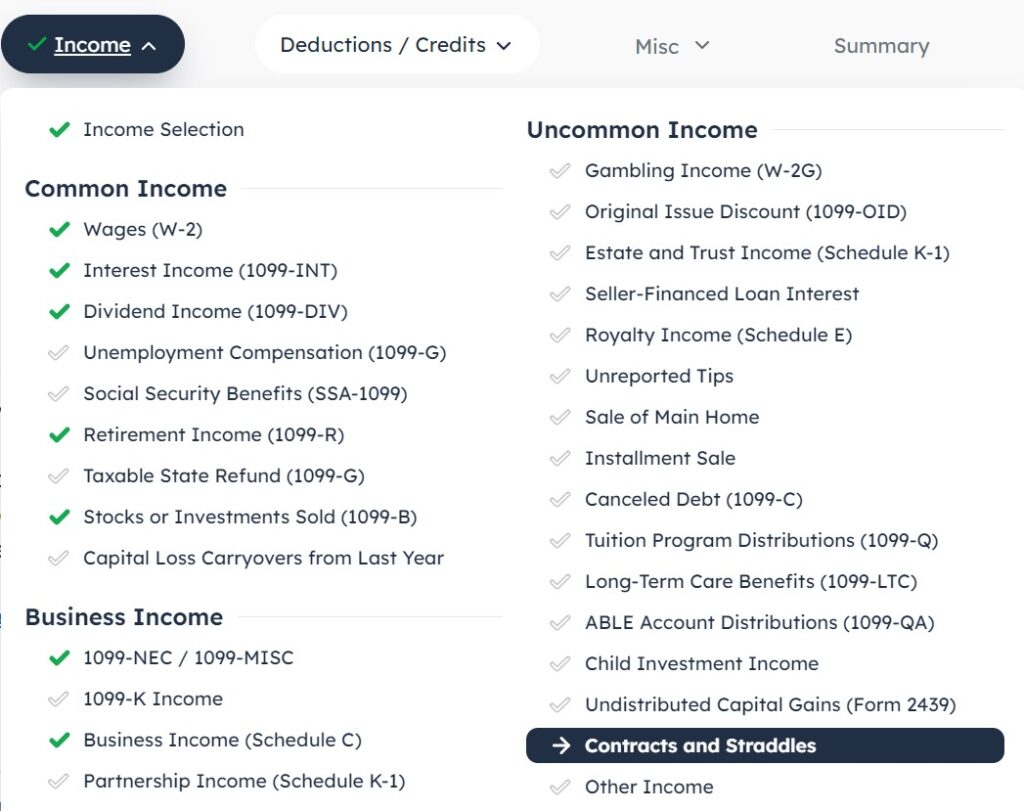

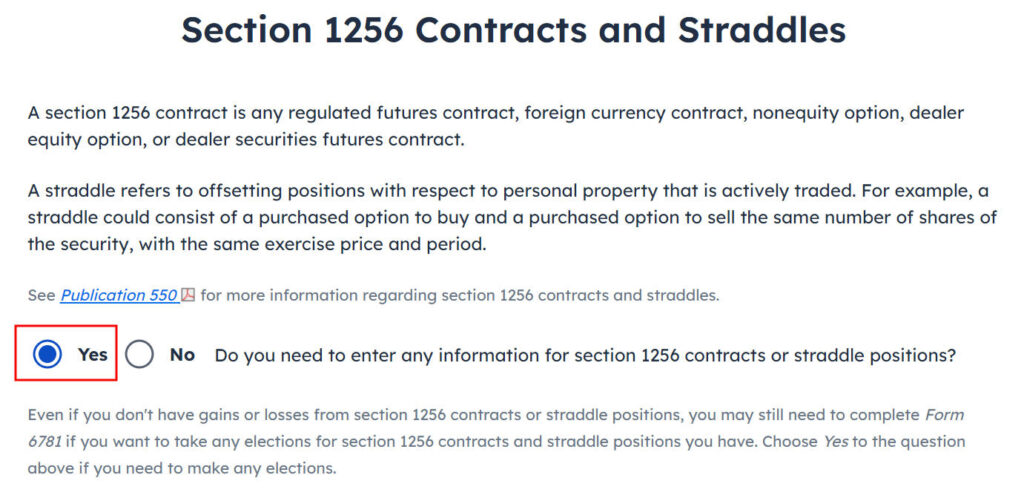

In FreeTaxUSA, discover “Contracts and Straddles” beneath Unusual Earnings within the Earnings part.

Reply “Sure” to get into the interview.

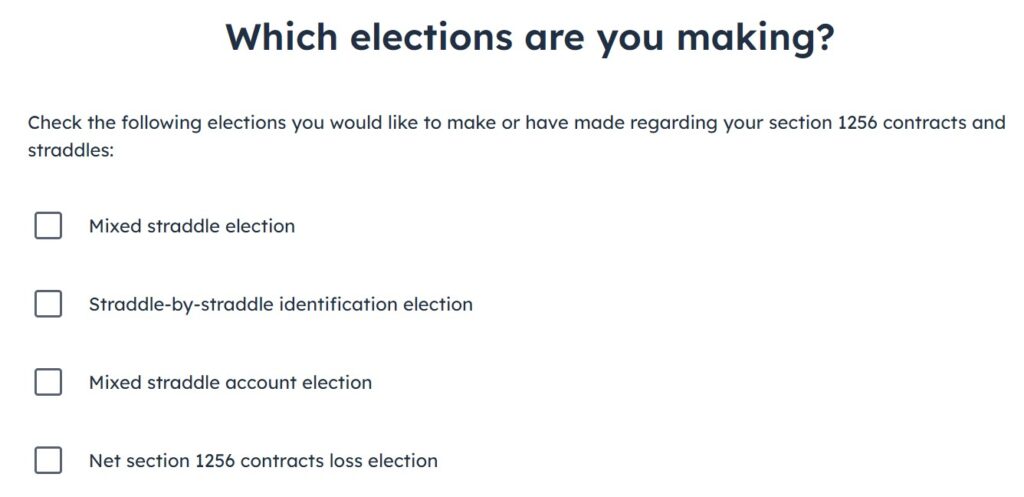

Maintain it easy and depart all the pieces clean right here.

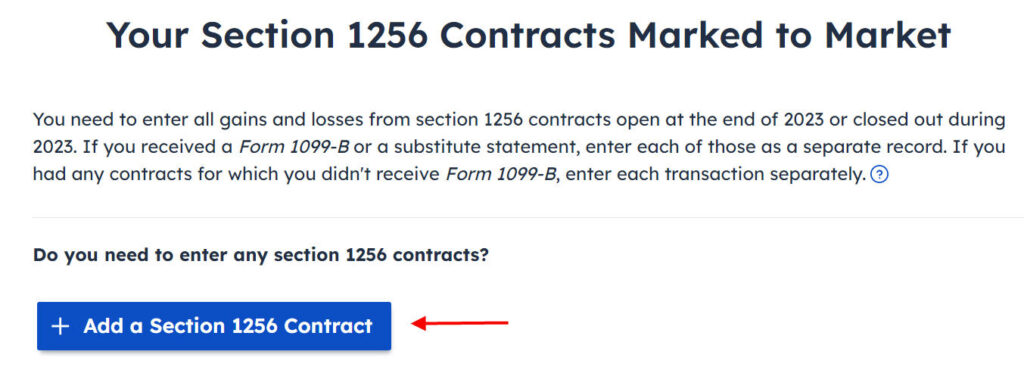

Click on on the “Add a Part 1256 Contract” button. Though the blurb and the button give the impression that you need to add every contract individually, the following display screen will point out which you can enter solely the overall quantity.

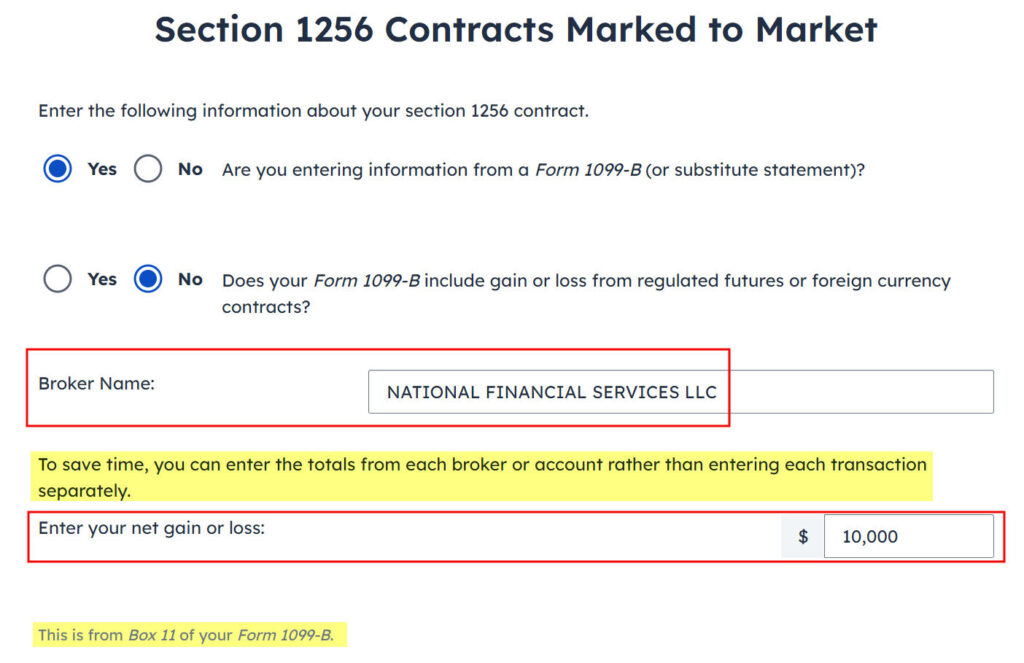

Enter the title of the dealer and the overall revenue or loss from Field 11 of the 1099-B type. Enter a adverse quantity if it’s a loss.

Repeat so as to add one other 1099-B when you traded field spreads at one other dealer.

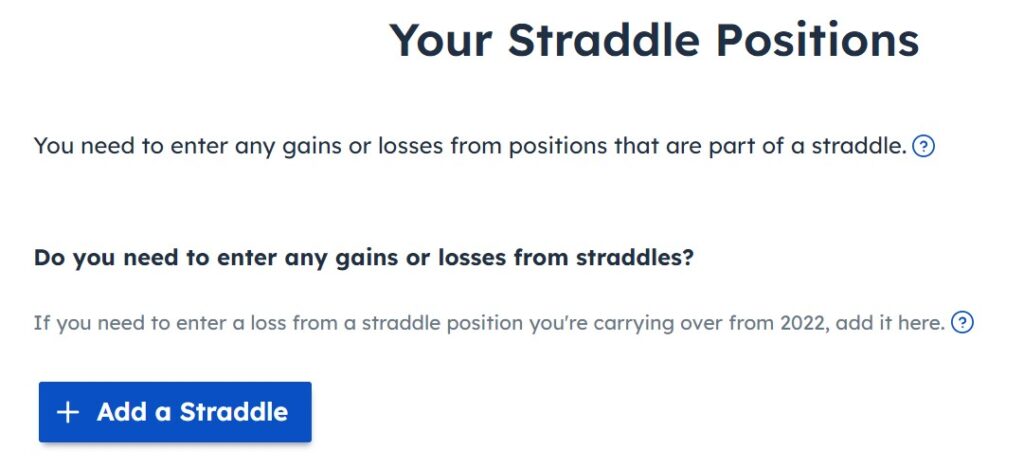

Click on on “No, Proceed” right here as a result of field spreads aren’t straddles.

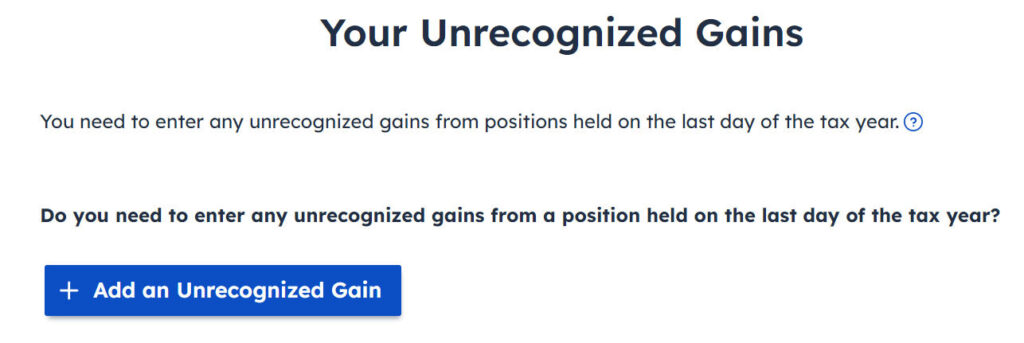

Click on on “No, Proceed” right here although you do have unrecognized features or losses in open contracts held December 31 as a result of these unrealized features and losses are already included within the combination revenue or loss in Field 11 of the 1099-B.

To confirm that the software program handled the features or losses accurately, scroll right down to the underside of the revenue abstract web page and discover the small “view PDF” hyperlink beneath Contracts and Straddles.

You see it’s damaged into 40% short-term capital achieve and 60% long-term capital achieve.

Say No To Administration Charges

In case you are paying an advisor a share of your property, you might be paying 5-10x an excessive amount of. Discover ways to discover an impartial advisor, pay for recommendation, and solely the recommendation.

[ad_2]